Eyes on the Economy: Labor Market, Airline Activity

Labor Market Struggles Reveal Slowing Economy

Payrolls increased by 661,000 jobs in September, less than half of August’s revised tally of 1.49 million and considerably less than the market expectation of 859,000 more workers. The drop is a strong indication the recovery is slowing as the pandemic persists. This is the third straight monthly decline in additions to nonfarm payrolls.

One unique aspect of the downturn has been the unusually high number of temporarily unemployed workers. Historically, a worker would generally not be classified as temporarily unemployed if out of work for more than six months. Many workers displaced by the pandemic have now reached that unfortunate milestone. In September, 9.1 million workers were in this category, down from 10.3 million in August. Some of these workers likely left the labor force. Meanwhile, the number of permanently displaced increased only modestly, from 4.1 million to 4.5 million. The shift into permanent unemployment is likely to increase until a widely available vaccine enables the economy to function more normally.

More than 120 major businesses have filed for bankruptcy and more are on the brink. Recently announced layoffs by Disney and airlines aren’t helping the situation. While the economy has recovered 11.4 million jobs since May, a deficit of 10.7 million remains. That’s a pretty deep hole.

Airline Industry Stalls ISM

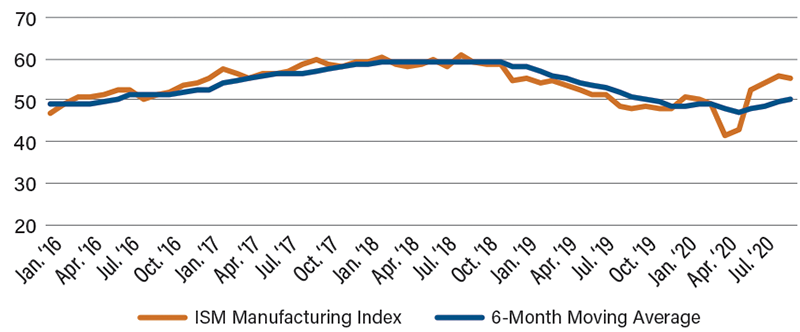

After posting solid gains over the past few months, the Institute for Supply Management Manufacturing Index took a step back in September, unexpectedly falling to 55.4 in September from 56 in August.

One segment of manufacturing that is struggling with no end in sight is nondefense aircraft. The value of new orders of nondefense aircraft has been negative in four of the past five months. Durable goods orders of aircraft are net of cancellations. This continues to weigh on industrial production for aerospace, which is 20 percent below its pre-COVID-19 level. Compare that with total manufacturing production, which is down roughly 5 percent.

Boeing has restarted production of the 737 MAX but reduced the number of planes it expects to build in 2020. It also pushed back new deliveries to the fourth quarter of this year. The company has lowered output of Dreamliners and 777s as well. Rival Airbus has also scaled back.

U.S. airlines also are under significant financial pressure and implemented large layoffs in early October. They could also cut new plane orders. Significant investment by airlines is unlikely until traffic returns to more normal levels, which will not by anytime soon.

Many businesses are trying to hold on until a vaccine is available. But even once an inoculation is approved, it will take time to produce and widely distribute it. The economic boost will take months. Even then, Americans’ skepticism about public health policy may temper acceptance. A recent NPR-PBS NewsHour-Marist Poll showed 35 percent of respondents would opt out of a COVID-19 vaccine; 60 percent would take it; and 5 percent were undecided.

ISM Manufacturing Index

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| ISM Manufacturing Index (Sept.) | 56.0 | 56.5 | 55.4 |

| Change in Nonfarm Payrolls (Sept.) (MoM) | 1,371,000 | 859,000 | 661,000 |

Key Interest Rates

| 10/12/20 | 10/5/20 | Change | |

|---|---|---|---|

| Fed Funds | 0.25% | 0.25% | -- |

| 1-mo. Libor | 0.15% | 0.14% | 0.01 |

| 3-mo. Libor | 0.22% | 0.22% | -- |

| 2-yr. UST | 0.16% | 0.14% | 0.02 |

| 5-yr. UST | 0.34% | 0.33% | 0.01 |

| 10-yr. UST | 0.79% | 0.78% | 0.01 |

| 30-yr. UST | 1.58% | 1.59% | -0.01 |

Rate Forecast - Futures Market

| Q4-20 | Q1-21 | Q2-21 | Q3-21 | |

|---|---|---|---|---|

| Fed Funds | 0.25% | 0.25% | 0.25% | 0.25% |

| 1-mo. Libor | 0.10% | 0.10% | 0.10% | 0.10% |

| 3-mo. Libor | 0.20% | 0.20% | 0.20% | 0.20% |

| 2-yr. UST | 0.20% | 0.20% | 0.20% | 0.30% |

| 5-yr. UST | 0.30% | 0.30% | 0.40% | 0.50% |

| 10-yr. UST | 0.70% | 0.70% | 0.80% | 0.90% |

| 30-yr. UST | 1.40% | 1.40% | 1.50% | 1.60% |