Eyes on the Economy: Payrolls, Inflation, Consumer Sentiment

Payrolls Remain Robust

The July employment report was strong and mostly in line with expectations as 943,000 jobs were added, slightly beating the consensus forecast of 870,000. The unemployment rate dropped more than expected, but participation in the labor force remains stubbornly weak. Importantly, while payroll employment is up by 16.7 million since April 2020, it remains 5.7 million below its pre-pandemic peak, meaning there is still a long recovery ahead.

The state of the labor market remains unprecedented as it keeps churning. Early in the pandemic, layoffs were the headline, but more recently the focus has shifted in favor of workers as job openings and quits have surged to record-high levels. Hiring issues for small businesses have been particularly acute. The latest NFIB survey shows that nearly half of all small-business owners reported unfilled job openings. The current mark is well above the peak rate in 2019, when the unemployment rate had fallen below 4 percent. Expect employers to face challenges through the end of 2021 as baby boomers retire and younger workers seek to change careers post-pandemic.

Signs Point to Inflation Being Temporary After All

Inflationary pressures are easing as the boost from the reopening of the economy fades and vehicle prices stabilize. The reopening of the economy was a one-time event that enhanced a number of components of the Consumer Price Index, including lodging away from home, vehicle rentals and airfares, along with admission to sporting and other events. Other one-time factors boosting inflation are the fiscal stimulus and global semiconductor shortage. Both have reduced the supply of new cars and raised prices at the dealership, which then increased demand for used vehicles. All this supports the Federal Reserve’s view that temporary factors are behind the recent surge in consumer prices.

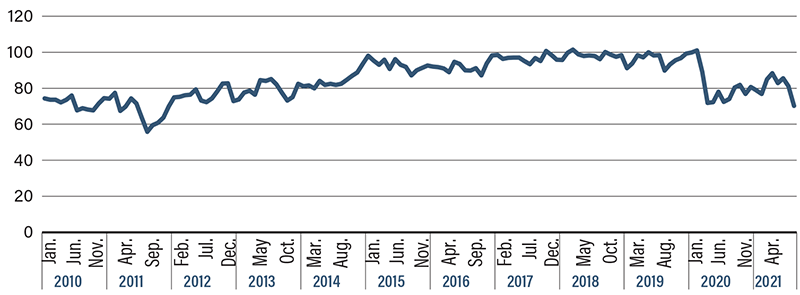

Consumer Sentiment Sinks to New Low

The combination of inflation and rising COVID cases is taking a toll on the U.S. consumer psyche. The University of Michigan’s Consumer Sentiment Index fell 11 points to 70.2 in August from 81.2 in July, according to preliminary estimates. That marks the lowest posting since 2011, indicating Americans are feeling even more deflated now than they did during the teeth of the pandemic. Consumers’ assessment of current conditions also dropped, moving from 84.5 to 77.9. Expectations continued the trend, plummeting nearly 14 points to 65.2 in August from 79 in July.

Inflation, including higher gas and food costs, along with surging COVID-19 cases are weighing on sentiment as consumers pay more at the pump and grocery stores while anticipating tighter restrictions.

Also, the delta variant has led a number of businesses to halt their plans to reopen offices. Such measures are likely to slow the momentum of the U.S. economic recovery but not change its positive trajectory.

University of Michigan Consumer Sentiment Index (2010–2021)

Source: Bloomberg

Source: Bloomberg

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| Change in Nonfarm Payrolls (July) (MoM) | 850,000 | 870,000 | 943,000 |

| Labor Force Participation Rate (Aug.) | 61.6% | 61.7% | 61.7% |

| Consumer Price Index (Aug.) (YoY) | 5.4% | 5.3% | 5.4% |

| University of Michigan Sentiment (Aug.) | 81.2% | 81.2% | 70.2% |

Key Interest Rates

| 8/16/21 | 8/9/21 | Change | |

|---|---|---|---|

| Fed Funds | 0.25% | 0.25% | -- |

| 1-mo. Libor | 0.09% | 0.10% | (0.01) |

| 3-mo. Libor | 0.12% | 0.13% | (0.01) |

| 2-yr. UST | 0.23% | 0.23% | -- |

| 5-yr. UST | 0.79% | 0.79% | -- |

| 10-yr. UST | 1.29% | 1.33% | (0.04) |

| 30-yr. UST | 1.94% | 1.96% | (0.02) |

Rate Forecast - Futures Market

| Q3-21 | Q4-21 | Q1-22 | Q2-22 | |

|---|---|---|---|---|

| Fed Funds | 0.25% | 0.25% | 0.25% | 0.25% |

| 1-mo. Libor | 0.10% | 0.12% | 0.15% | 0.20% |

| 3-mo. Libor | 0.20% | 0.20% | 0.25% | 0.30% |

| 2-yr. UST | 0.25% | 0.30% | 0.35% | 0.40% |

| 5-yr. UST | 0.80% | 0.90% | 1.00% | 1.10% |

| 10-yr. UST | 1.70% | 1.80% | 1.89% | 1.96% |

| 30-yr. UST | 2.10% | 2.20% | 2.30% | 2.40% |