Eyes on the Economy: Payrolls, Manufacturing

Payrolls: Upbeat, But with Mixed Messages

The June employment report was a real eye catcher with payroll gains notching their strongest tally since last summer’s reopening surge. However, a closer look reveals that a significant share of the 850,000-job gain came from private and public school payrolls, as fewer educators than normal left jobs at the end of the school year.

With the further lifting of pandemic-related restrictions, payroll gains were robust in consumer industries, especially leisure/hospitality and retail trade. Average earnings increased for the third consecutive month, climbing 10 cents for all employees to $30.40 an hour. The Bureau of Labor Statistics said the rising wages reflect higher demand for labor. Yet the deficit of 6.8 million jobs compared with the February 2020 employment peak remains large, and the labor force participation rate of 61.6 percent falls short of the 63 percent prior to the pandemic. The unemployment rate increased slightly to 5.9 percent rather than declining as expected.

A number of indicators point to the normalizing labor market, including a decline in telecommuting, a decrease in the number of workers staying out of the labor force because of pandemic fears, and a drop in involuntary part-time staff and marginally attached workers. Economists expect the labor market to continue to climb back to health. All jobs lost during the pandemic will be recovered by the second half of 2022, and the labor market will return to full employment. Further constraints to participation should fall away with the reopening of schools in the fall, an increase in vaccinations and, to a lesser extent, the sunsetting of enhanced and extended unemployment benefits. However, employers may still have difficulty filling jobs due to the seismic shift of retiring baby boomers and the desire of many workers to change careers post-pandemic.

Manufacturing Takes a Step Back

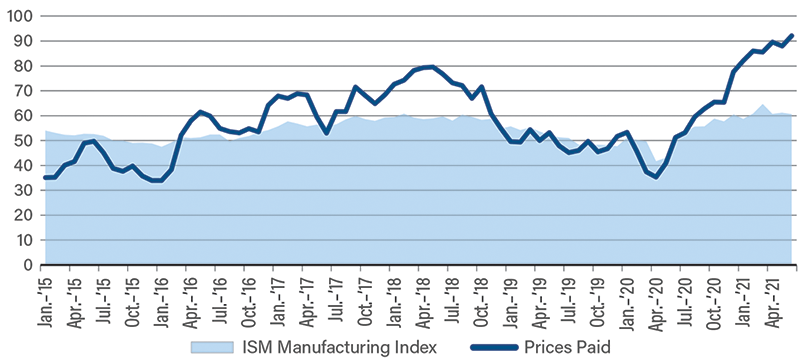

U.S. economic growth this cycle may have peaked, but that doesn’t mean the economy won’t thrive through the rest of this year and next. The Institute for Supply Management Manufacturing Index fell from 61.2 in May to 60.6 in June. Odds are it will drop further over the next few months, as the index doesn’t normally spend too much time north of 60.

U.S. manufacturing is holding up well despite the labor supply issues, bottlenecks in global supply chains and a semiconductor shortage. Manufacturers are benefiting from U.S. consumers flush with cash, improvement in exports and the need for businesses to replenish inventories. The details softened as new orders dropped and the employment index fell below its neutral threshold of 50. The prices-paid index continued to climb, but a number of commodity prices have fallen recently, which could help take the edge off prices paid. If that happens, the softening trend would certainly back up the Federal Reserve’s assertion that the current inflationary spike is temporary.

Institute for Supply Management: Manufacturing vs. Prices Paid

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| ISM Manufacturing Index (June) | 61.2 | 60.9 | 60.6 |

| Change in Nonfarm Payrolls (June) | 559K | 720K | 850K |

| Average Hourly Earnings (June) (YoY) | 2.0% | 3.6% | 3.6% |

Key Interest Rates

| 7/6/21 | 6/28/21 | Change | |

|---|---|---|---|

| Fed Funds | 0.25% | 0.25% | -- |

| 1-mo. Libor | 0.10% | 0.08% | 0.02 |

| 3-mo. Libor | 0.14% | 0.12% | 0.02 |

| 2-yr. UST | 0.24% | 0.16% | 0.08 |

| 5-yr. UST | 0.86% | 0.80% | 0.06 |

| 10-yr. UST | 1.44% | 1.51% | (0.07) |

| 30-yr. UST | 2.05% | 2.19% | (0.14) |

Rate Forecast - Futures Market

| Q3-21 | Q4-21 | Q1-22 | Q2-22 | |

|---|---|---|---|---|

| Fed Funds | 0.25% | 0.25% | 0.25% | 0.25% |

| 1-mo. Libor | 0.15% | 0.20% | 0.20% | 0.20% |

| 3-mo. Libor | 0.25% | 0.30% | 0.30% | 0.30% |

| 2-yr. UST | 0.30% | 0.40% | 0.40% | 0.40% |

| 5-yr. UST | 1.10% | 1.20% | 1.20% | 1.20% |

| 10-yr. UST | 1.85% | 1.95% | 1.95% | 1.95% |

| 30-yr. UST | 2.60% | 2.70% | 2.70% | 2.70% |