Eyes on the Economy: Production, Trade, Payrolls

Infrastructure Investment Should Boost Production

President Biden’s American Jobs Plan includes a hefty amount earmarked for infrastructure spending that will benefit an array of manufacturing sectors, including autos, steel, asphalt, concrete, building materials, tech and utilities. Closer to heart, the president wants to invest in upgrading the power grid, which could garner more support given the recent weather-related outages in parts of the country. His plan also calls for more investment in clean-energy technologies, including electric vehicles.

The need for infrastructure investment is clear. The average age of the nation’s highways is close to 30 years, double what it was in the 1960s. American dams are decades older. More than 70 percent of Americans favor the massive undertaking, but the means to pay for it has been a stumbling block in the past. Expect Biden’s plan to be funded from higher corporate taxes and deficit spending.

While all that future investment will be good for the economy, expect manufacturing to struggle for the next few months, especially as the global semiconductor shortage remains problematic and has no viable short-term solution.

No Relief on Trade Deficit

Trade is an important economic driver, but it can be quite volatile—and this year is no exception. February’s nominal trade deficit was the widest since the inception of the data in the early 1990s. Economists expect trade to be a significant drag in 2021 as businesses seek to replenish inventories and consumer spending ramps up, both of which mean more imports will be necessary. Infrastructure spending also will contribute to the imbalance as the investment impacts the cost of production and relies on imports.

Payrolls Continue to Surprise as Consumer Confidence Grows

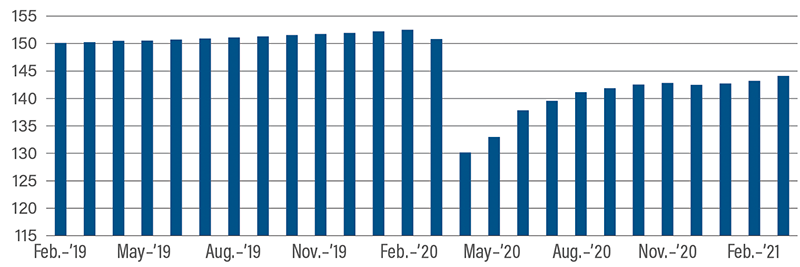

The labor market received another big surprise last month when jobs surged by 916,000—the best reading since last August. Economists say this could be the beginning of a sustained run of job growth to the industries hardest hit during the pandemic. Job growth of roughly 100,000 is expected to keep unemployment unchanged, but during this recovery economists are forecasting monthly gains on average of 514,000 over the next year. The unemployment rate fell to 6.0 percent, which is also a pandemic low. That said, there are still 9.4 million fewer jobs today than in February 2020. The employment rebound is gaining momentum as more people are vaccinated, states lift restrictions and consumers grow comfortable dining, shopping and traveling outside their homes. This is the seismic wave that economists have been forecasting and financial markets have been anticipating. The confluence of additional federal stimulus, growing consumer confidence and the feeling that the pandemic is close to abating is propelling economic growth and hiring. Recent data show restaurant, hotel and airlines bookings are up while consumers spent more money at gyms, salons and spas in the past month than they have in more than a year.

Cumulative Nonfarm Payrolls (Numbers in Millions)

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| Factory Orders (Feb.) (MoM) | 2.6% | (0.5%) | (0.08%) |

| International Trade (Feb.) | ($68.2B) | ($70.5B) | ($71.1B) |

| Nonfarm Payrolls (Mar.) (MoM) | 379K | 630K | 916K |

Key Interest Rates

| 4/12/21 | 4/05/21 | Change | |

|---|---|---|---|

| Fed Funds | 0.25% | 0.25% | -- |

| 1-mo. Libor | 0.11% | 0.11% | -- |

| 3-mo. Libor | 0.19% | 0.20% | (0.01) |

| 2-yr. UST | 0.18% | 0.17% | 0.01 |

| 5-yr. UST | 0.89% | 0.94% | (0.05) |

| 10-yr. UST | 1.69% | 1.73% | (0.04) |

| 30-yr. UST | 2.34% | 2.36% | (0.02) |

Rate Forecast - Futures Market

| Q2-21 | Q3-21 | Q4-21 | Q1-22 | |

|---|---|---|---|---|

| Fed Funds | 0.25% | 0.25% | 0.25% | 0.25% |

| 1-mo. Libor | 0.10% | 0.10% | 0.20% | 0.20% |

| 3-mo. Libor | 0.20% | 0.20% | 0.30% | 0.30% |

| 2-yr. UST | 0.30% | 0.30% | 0.40% | 0.40% |

| 5-yr. UST | 1.00% | 1.10% | 1.20% | 1.20% |

| 10-yr. UST | 1.78% | 1.85% | 1.95% | 1.95% |

| 30-yr. UST | 2.53% | 2.60% | 2.70% | 2.70% |