Eyes on the Economy: Retail Sales, Consumer Confidence

Year-Over-Year Retail Sales Are Meaningless

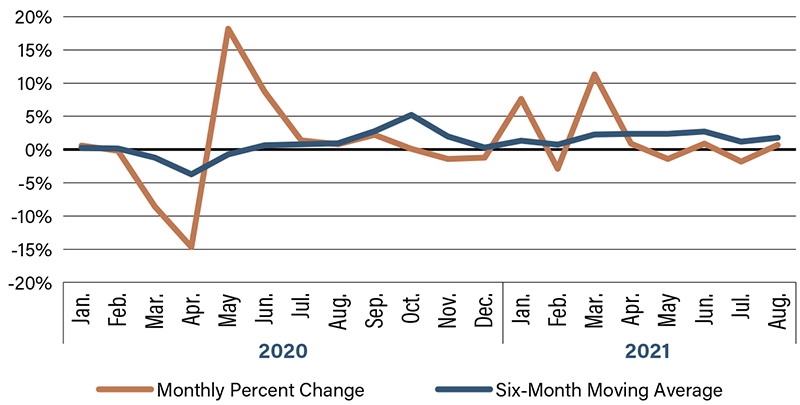

Monthly U.S. retail sales unexpectedly rose in August, beating the market’s above-consensus forecast of a small drop, while year-over-year sales remained flat. There was a large downward revision to July, partially offsetting the surprise. Total sales were up 0.7 percent, and if autos were excluded sales rose 1.8 percent. Growth was led by non-store retailers where sales rebounded after falling in July.

Year-over-year growth doesn’t provide much insight, holding steady at 15.1 percent. Increased delta variant infections appear to be slowing the return to normal spending levels, with flat restaurant sales and surging grocery store sales. The recent jump in cases may be temporarily dampening consumer spending. Month-over-month sales figures show some strength; lofty year-over-year figures remain somewhat meaningless because they compare with sales still pressured by last year’s lockdowns. A better comparison is to 2019, highlighting the ongoing strength of sales. Sales in total have grown 8.9 percent per year over the last two years, and sales excluding auto dealers are up 9.3 percent per year. The outlook is mixed with high levels of infections and weakened confidence as potential drags. Consumers’ desire to shift spending back to services is another weight, although its timing is uncertain given infections and government restrictions on activity. There was so much spending on goods since the middle of last year that demand has likely peaked. Another risk comes from asset prices in general and the stock market in particular. Many market watchers consider the stock market to be overvalued and a sharp correction could be a blow to confidence and consumers’ willingness to spend.

Consumer Confidence Nears Decade Low

Both the Conference Board Consumer Confidence Survey and University of Michigan Index of Consumer Sentiment continued their descent due to the slowing U.S. economy, jump in COVID-19 cases and the temporary acceleration in inflation. The Consumer Confidence Index fell from an upwardly revised 115.2 in August to 109.3 in September. The decline in the index was more than the markets’ consensus forecast. The University of Michigan’s sentiment index saw a small rise from 70.3 in August to a preliminary estimate of 71 in September, and remains near its lowest reading since 2011.

Inflation and infections are not the only drag for both measures; however, as government stimulus is at a low point since the onset of the pandemic, unemployment is high and labor-force participation remains depressed despite record job openings. The impact of stock market movements is unclear, especially with the recent selloff in the technology sector as interest rates have begun to rise in anticipation of the Federal Reserve starting its tapering program in November. With inflation spiking for many commodities, most economists believe the Fed will raise interest rates by at least a quarter of a percentage point in 2022, which is a year earlier than the Fed forecasted. Should the Fed have to act more aggressively, look for the stock market to continue its sell-off and consumer confidence to sink even further.

Seasonally Adjusted U.S. Retail and Food Services Sales

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| Retail Sales (Aug.)(MoM) | -1.1% | -0.7% | 0.7% |

| University of Michigan Sentiment (Sept.) | 70.3 | 72 | 71 |

| Conference Board Consumer Confidence (Sept.) | 115.2 | 115.0 | 109.3 |

Key Interest Rates

| 9/27/21 | 9/20/21 | Change | |

|---|---|---|---|

| Fed Funds | 0.25% | 0.25% | -- |

| 1-mo. Libor | 0.08% | 0.09% | (0.01) |

| 3-mo. Libor | 0.13% | 0.13% | -- |

| 2-yr. UST | 0.31% | 0.23% | 0.08 |

| 5-yr. UST | 0.98% | 0.83% | 0.15 |

| 10-yr. UST | 1.48% | 1.31% | 0.17 |

| 30-yr. UST | 1.99% | 1.85% | 0.14 |

Rate Forecast - Futures Market

| Q4-21 | Q1-22 | Q2-22 | Q3-22 | |

|---|---|---|---|---|

| Fed Funds | 0.25% | 0.25% | 0.25% | 0.25% |

| 1-mo. Libor | 0.12% | 0.15% | 0.20% | 0.20% |

| 3-mo. Libor | 0.20% | 0.25% | 0.30% | 0.30% |

| 2-yr. UST | 0.40% | 0.45% | 0.50% | 0.50% |

| 5-yr. UST | 1.05% | 1.10% | 1.20% | 1.20% |

| 10-yr. UST | 1.80% | 1.89% | 1.96% | 1.96% |

| 30-yr. UST | 2.20% | 2.30% | 2.40% | 2.40% |