Eyes on the Economy: Vehicle Sales, Manufacturing, Business Outlook

Vehicle Sales Slowing

When an economy goes into recession, economists focus on certain indicators to gauge the nation’s economic health. One signpost is new-car sales. After rebounding from a dismal April, new-vehicle sales continue to sputter in August—down 2 million units from this time last year on a seasonally adjusted basis. It is difficult to imagine consumers being revved up to make such a big purchase with so many Americans out of work and fiscal relief dried up. With the average price of a new vehicle topping $37,000 according to Kelly Blue Book, who needs a hefty monthly payment right now?

There are several factors supporting car sales for those who do want to buy. The finance market is willing and able to lend to qualified borrowers. Further, many workers in higher-income fields have been missed by the path of the economic cyclone—yet another example of the so-called K-shaped recovery that highlights the differences between the “haves” and “have-nots” in terms of buying power.

U.S. Manufacturing Improves

U.S. manufacturing continues to recover from the recession, and the improvement is expanding. The Institute for Supply Management Manufacturing Index increased from 54.2 in July to 56.0 in August. America’s manufacturing workforce has fallen 25 percent over the past two decades, but it still represents an important part of the economy, totaling 12.8 million jobs.

The surging housing market is helping some manufacturers. Demand for construction materials has increased, which has sent lumber prices soaring over the past few months. Manufacturing conditions are improving, but risks to the market outlook remain weighted to the downside without additional fiscal stimulus.

Business Outlook Better, But Uncertainty Lingers

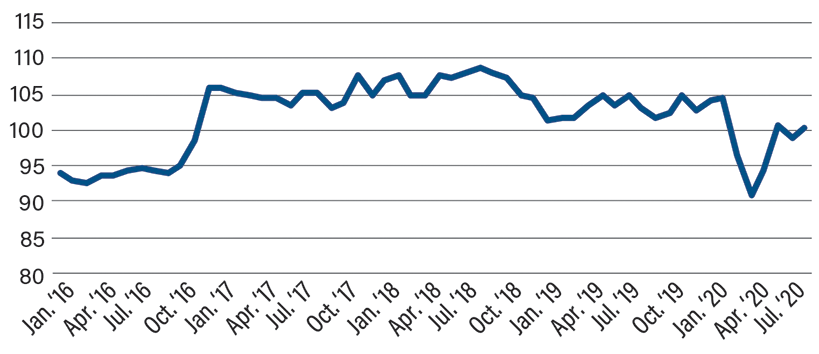

The NFIB Small Business Optimism Index increased 1.4 points in August to 100.2, which follows July’s 1.8-point decline. Seven of the index’s 10 components improved from July to August, while two declined and one held steady. Though small-business owners’ outlook improved, the NFIB’s Uncertainty Index rose to 90, the second-highest reading since 2017.

Fewer small-business owners expect sales to increase or see a broader economic improvement on the horizon. Luckily, the number of owners reporting that credit is harder to come by is low. Cheap, readily available debt leads to capital investment, and hiring comes with expansion. Small-business owners appear to be responding, though the near-term uncertainty engulfing the economy may keep a lid on borrowing. The percentage of business owners who believe now is a good time to expand bounced back after April but has since gone sideways.

The combination of a stalemate over further fiscal stimulus, the unknown timing of an effective COVID-19 vaccine, and the upcoming presidential election is pushing many business owners to sit on their hands, waiting for a clearer view of the economic landscape to emerge.

NFIB Small Business Optimism

All referenced economic data sourced from Bloomberg.

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| Vehicle Sales (Aug.) | 14.52M | 14.90M | 15.19M |

| ISM Manufacturing Index (Aug.) | 54.2 | 54.8 | 56 |

| NFIB Small Business Optimism (Aug.) | 98.8 | 99.0 | 100.2 |

| Jobless Claims (Aug. 15) | 963K | 1,185K | 1,106K |