Eyes on the Economy: Business Optimism, Inflation, Job Gains

Business Optimism Falls to Four-Month Low

The National Federation of Independent Business (NFIB) Small Business Optimism Index decreased to 90.8 in September, the lowest in four months and marking the 21st consecutive month of reading below the historical average of 98. Inflation remained the top concern in business operation.

Filling job openings remained a challenge for 43% of business owners. Meanwhile, sales growth slowed and material costs increased, squeezing profitability. Business owners also reported that they raised average selling prices, suggesting inflationary pressure remains an issue. Price increases were reportedly the most frequent in the financial sector (75%) due to rising interest rates, followed by construction (53%), retail (49%), services (33%) and wholesale (33%). Furthermore, a net 39% said they planned more price hikes.

Consumer Inflation Expectations Tick Up

In September, U.S. consumers said they expected inflation for the year ahead to be 3.7%, slightly up from 3.6% in the previous month and hitting the highest posting in three months. The expectation was more pronounced for food prices—up to 5.6% from 5.3%. The change in was consistent with the recent inflation trend that saw the headline Consumer Price Index also rise.

Meanwhile, the yearly Producer Price Index (PPI) re-accelerated to 2.2%, the highest tally since April and well above market forecasts of 1.6%. Core PPI—excluding food and energy—re-accelerated to 2.7% from 2.5%, also well above market forecasts. The uptick is a cause for concern in consumer inflation as producers facing rising prices are likely to pass on higher costs to buyers. This is consistent with what we see in the consumer inflation trend, which has caused buyers to expect increased inflation.

Labor Market Still Leaves Room for More Hikes

The U.S. economy added 336,000 jobs in September, sharply above market forecasts of 170,000. It is the largest job gain in eight months and significantly higher than the number of monthly new jobs needed to keep up with working-age population growth. Job gains were led by leisure and hospitality (96,000), government (73,000), health care (41,000), professional services (29,000) and social assistance (25,000). Other major industries—such as construction, manufacturing and financial services—saw little change in employment.

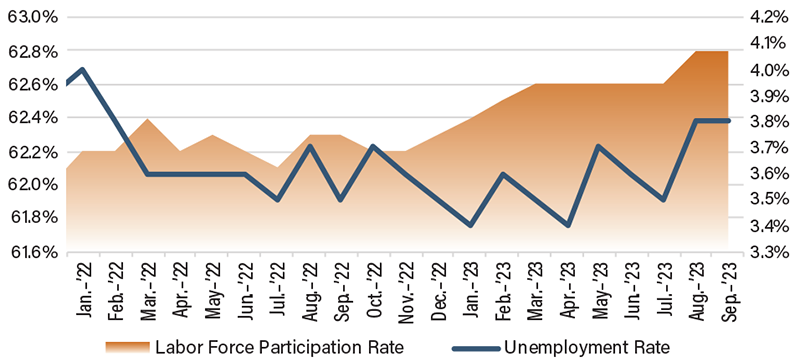

The labor force participation rate remained unchanged at 62.8% while the unemployment rate continued to hold at 3.8%. Note that both the participation rate and the unemployment rate are derived from the Bureau of Labor Statistics’ household survey, which is different from the payroll survey that is used to count job gains. The two surveys tell two different stories. On the one hand, the household survey shows that not much changed in the labor market. On the other hand, the payroll survey suggests there was an acceleration. Diving deeper, however, the payroll survey shows that average weekly hours stalled at 34.4, which is more or less close to pre-COVID levels. Wage growth has also trended down but remained higher than pre-COVID. Overall, the labor still leaves room for more rate hikes.

Labor Force Slowly Eases Up

Source: Trading Economics.

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| NFIB Business Optimism Index (Sep.) | 91.3 | 91.4 | 90.8 |

| Consumer Inflation Expectations (Sep.) | 3.6% | 3.2% | 3.7% |

| Nonfarm Payrolls (Sep.) | 227K | 170K | 336K |

| Unemployment Rate (Sep.) | 3.8% | 3.7% | 3.8% |