Eyes on the Economy: Export Prices, Housing Market, Looming Recession

Export Prices Still Rising

You might recall our previous discussion on the effect of rising export prices on the trade account and, ultimately, its impact on growth in U.S. gross domestic product. Export prices continued to rise in the second quarter with May seeing a year-over-year increase of 18.9 percent higher than the prior month and the forecasted figures. By the same measure, growth in import prices edged down slightly from 12 percent to 11.7 percent. The movements in opposite directions further widened the gap between import and export prices, which could make American-made goods less attractive and hurt the U.S. trade account.

However, global shortages of goods such as petroleum products and motor vehicles strengthened U.S. exports in May. Additionally, goods imports saw a slight decline, possibly explained by lockdowns in China, which delayed shipment. Overall, the U.S. goods trade deficit improved in May although it remained higher than pre-pandemic levels. This gives hope that the trade deficit will not drag down growth as it did in the first quarter.

Housing Market Is Slowing

With the average mortgage rates topping 6 percent and high inflationary pressure on building material costs, housing starts declined 14.4 percent from April to 1.549 million units in May, the lowest count in 13 months. Building permits declined 7 percent over the same period to 1.695 million. This is the second consecutive month of decline. Both are leading indicators on the supply side, suggesting how many new homes will be available in the market.

Pending home sales unexpectedly rose 0.7 percent in May from the previous month but declined 13.6 percent when compared with a year ago. Existing-home sales decreased 3.4 percent on a monthly basis while new-home sales increased 10.7 percent. Although the housing market is surely slowing down, it appears that the supply side is hitting the brake harder than the demand side with the unexpected rise in sales likely reflecting homebuyers rushing to seal the deal in anticipation of higher rates.Another index tracking the manufacturing sector edged down to 57 in May from 59.2 the previous month—also the slowest expansion rate since January. Manufacturing cost inflation increased at the fastest rate in six months, leading companies to pass on rising expenses to consumers as reflected in a near-record hike in output charges.

Recession Looms as the Fed Gets More Hawkish

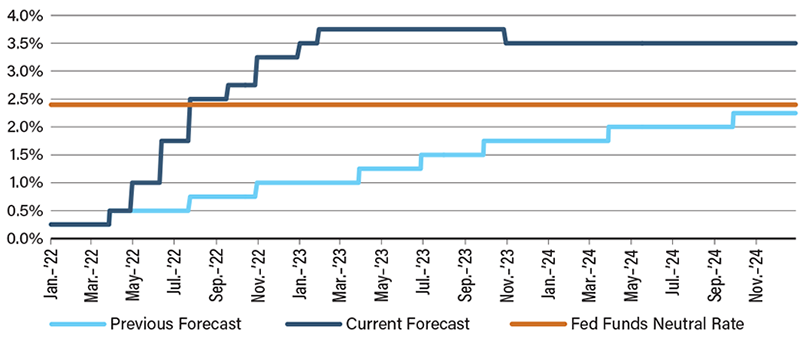

In its May press conference, the Fed rejected the idea of a 75-basis-point hike only to change its heart a month later. With inflation proving that its worst was yet to come, the Fed once again appeared to have underestimated the persistency of the current rising prices. At its June meeting, the Fed approved the largest interest rate increase since 1994 and signaled more rate lifting at the most rapid pace in decades for the remainder of this year. The Fed’s economic projections indicate that all officials who participated in the meeting expect rates to increase to at least 3 percent this year, with half expecting rates to rise to around 3.375 percent.

Once a key selling point, a soft landing—in which rates rise just enough to bring down inflation without inducing a recession—now appears further out of reach, admitted Fed Chairman Jerome Powell. In its latest estimates, Goldman Sachs economists place a cumulative probability of a recession in the next two years at 48 percent, up from their previous estimate of 35 percent. Although it appears there is still a good chance for the economy to avoid a recession this year, the risk is rising and the odds of avoiding one altogether are quickly fading.

Federal Funds Rate Expected to Top 3% This Year

Sources: Federal Reserve; Bloomberg; estimates based on FOMC participants' assessments and 30-day Fed funds future contracts

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| Export Prices (May)(YoY) | 18.0% | 18.3% | 18.9% |

| Goods Trade Balance (May) | $-105.94B | $-104.8B | $-104.3B |

| Housing Starts (May)(MoM) | 5.5% | -1.5% | -14.4% |

| Federal Funds Rate | 1.00% | 1.50% | 1.75% |

Key Interest Rates

| 6/27/22 | 6/21/22 | Change | |

|---|---|---|---|

| Fed Funds | 1.75% | 1.75% | - - - |

| 1-mo. Libor | 1.65% | 1.64% | 0.01 |

| 3-mo. Libor | 2.23% | 2.15% | 0.08 |

| 2-yr. UST | 3.11% | 3.20% | (0.09) |

| 5-yr. UST | 3.23% | 3.36% | (0.13) |

| 10-yr. UST | 3.18% | 3.28% | (0.10) |

| 30-yr. UST | 3.31% | 3.34% | (0.03) |

Rate Forecast - Futures Market

| Q3-22 | Q4-22 | Q1-23 | Q2-23 | |

|---|---|---|---|---|

| Fed Funds | 2.90% | 3.45% | 3.65% | 3.65% |

| 1-mo. Libor | 3.25% | 3.71% | 3.70% | 3.57% |

| 3-mo. Libor | 3.29% | 3.78% | 3.79% | 3.67% |

| 2-yr. UST | 3.06% | 3.11% | 3.16% | 3.13% |

| 5-yr. UST | 3.19% | 3.18% | 3.22% | 3.23% |

| 10-yr. UST | 3.19% | 3.17% | 3.22% | 3.26% |

| 30-yr. UST | 3.31% | 3.33% | 3.37% | 3.42% |