Eyes on the Economy: Factory Orders, Productivity, Job Growth

Factory Orders Decline

New orders for U.S. manufactured goods fell 1 percent in July, the first month-over-month decline in 10 months, reflecting cooling demand for goods as the economy slows. In a surprise to economists, the decline was partly driven by a decrease in orders for nondurable goods while durable goods orders edged down slightly.

July also saw a decline in shipments of manufactured goods after 16 consecutive monthly increases. With inventories reportedly increased, the inventories-to-shipments ratio edged up slightly to 1.47 in July from 1.46 in June. This could potentially lead to a pileup in inventories; however, the change is small and not yet alarming.

Productivity Continues To Fall; Labor Costs Jump

U.S. labor productivity fell at an annualized quarter-over-quarter rate of 4.6 percent in the second quarter of 2022, posting a second consecutive decline this year. Compared with the same quarter in 2021, productivity decreased 2.4 percent—the largest yearly decline since records began in 1948. Unit labor costs jumped 10.2 percent, driven by a 5.7 percent increase in hourly compensation and a 4.1 percent decline in productivity. Over the last four quarters, unit labor costs rose 9.3 percent, the largest four-quarter increase since 1982.

Overall, the report paints a troubling image of the production side of the economy. As inflation pushes demand for higher compensation, production costs rise. However, compensation is increasing at lower rates than inflation, possibly causing workers to feel underpaid and become less productive. This is an example of how inflation hurts the economy in more ways other than the high price levels consumers face at the market.

The question now is whether productivity is still declining, which could lead to another quarter of negative growth.

Job Growth Decelerates But Remains Solid in August

Job growth may be slowing, but August saw the economy adding 315,000 jobs, lower than July’s figure but still above forecast. Take caution in reading the figure as August is historically a weaker month for employment; therefore, a lower number does not necessarily point to sustained deceleration.

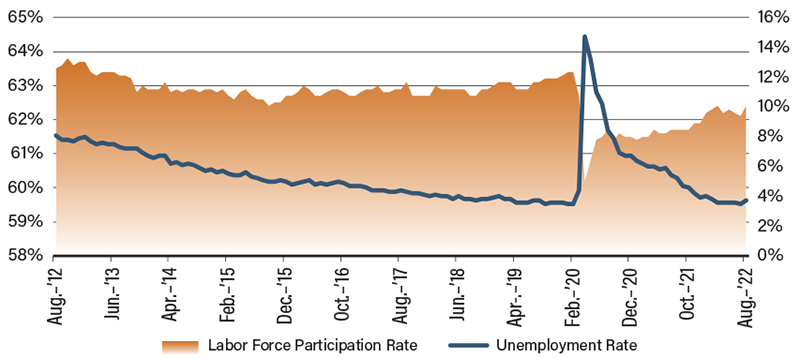

The reported job gains were broad across sectors, with professional and business services adding the biggest gains followed by healthcare, retail trade, manufacturing, and leisure and hospitality. Average hourly earnings increased 5.2 percent from a year ago. With the labor force participation rate edging up 0.3—to a five-month high of 62.4 percent—and the number of unemployed persons rising to 6 million, the unemployment rate jumped to 3.7 percent. It is worth noting that the number of unemployed persons returned to its pre-COVID February 2020 level in July but is now on the rise again.

The employment report gives us a look into what we may expect from the Federal Reserve. The slowdown in growth may suggest that its tightening policy is in the working. On the other hand, the above-forecast figure may also pave the way for the Fed to move forward with further rate hikes to tame the economy in its battle against inflation.

Unemployment Returns to Pre-COVID Level While Labor Force Struggles

Source: Bloomberg

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| New Orders for Manufuctured Goods (Jul.)(MoM) | 1.8% | 0.2% | -1.0% |

| Annualized Nonfarm Labor Productivity (Q2)(QoQ) | -7.4% | -4.5% | -4.1% |

| Nonfarm Payrolls (Aug.)(MoM) | 526K | 300K | 315K |

| Unemployment Rate (Aug.) | 3.5% | 3.5% | 3.7% |

Key Interest Rates

| 9/6/22 | 8/29/22 | Change | |

|---|---|---|---|

| Fed Funds | 2.50% | 2.50% | - - - |

| 1-mo. Libor | 2.68% | 2.56% | 0.12 |

| 3-mo. Libor | 3.17% | 2.08% | 1.09 |

| 2-yr. UST | 3.50% | 3.43% | 0.07 |

| 5-yr. UST | 3.44% | 3.25% | 0.19 |

| 10-yr. UST | 3.33% | 3.11% | 0.22 |

| 30-yr. UST | 3.47% | 3.24% | 0.23 |

Rate Forecast - Futures Market

| Q3-22 | Q4-22 | Q1-23 | Q2-23 | |

|---|---|---|---|---|

| Fed Funds | 3.05% | 3.55% | 3.65% | 3.60% |

| 1-mo. Libor | 2.92% | 4.10% | 4.10% | 4.05% |

| 3-mo. Libor | 3.42% | 4.14% | 4.18% | 4.13% |

| 2-yr. UST | 3.21% | 3.31% | 3.26% | 3.16% |

| 5-yr. UST | 3.10% | 3.14% | 3.10% | 3.05% |

| 10-yr. UST | 2.99% | 3.06% | 3.06% | 3.03% |

| 30-yr. UST | 3.17% | 3.24% | 3.25% | 3.24% |