Eyes on the Economy: GDP, Consumer Sentiment, Labor Market

Government Spending, Real GDP Decline

The second quarter of 2022 was marked by another negative growth rate in real gross domestic product (GDP). It posted growth of -0.9 percent to the surprise of many who projected positive growth of 0.5 percent. The decline was driven by decreases in private inventory investment, fixed investment and government spending at city, state and federal levels.

The decline in federal government spending was less significant than in the first quarter, making it only partly responsible for the second quarter’s lack of growth. The fed’s spending decline was largely driven by the sale of crude oil from the Strategic Petroleum Reserve, which resulted in a corresponding decrease in government consumption expenditures. Meanwhile, inventory investment saw a second consecutive quarter of decline, and personal consumption slowed as well. This, however, was partly offset by the deceleration of imports and improvement in exports.

Consumer Sentiment Rises Slightly from Historic Low

After reaching a record low in June, the University of Michigan Index of Consumer Sentiment improved 51.5 in July from June’s tally of 50 even. Most components of the index saw little change while the rating for buy conditions improved from last month as a result of American’s perceptions of easing supply constraints.

The Index of Consumer Expectations dropped to 47.3, the lowest reading since May 1980. The index comprises three areas: prospects for one’s personal financial situation, prospects for the general economy in the near term and prospects for the economy in the long term. The sub-index for one-year economic outlooks declined to its lowest ranking since 2009 while concerns over global factors improved. This suggests that, while consumers became less concerned about global crises, they saw the domestic economy deteriorating in the short term with inflation continuing to dominate their focus.

Enigmatic U.S. Labor Market Continues To Surprise

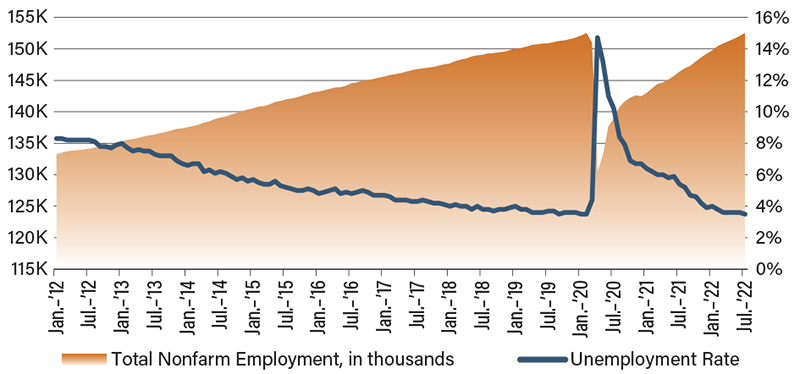

The U.S. economy once again surprised markets with nonfarm payrolls beating forecasts and adding 528,000 jobs in July. This brought the unemployment rate down to 3.5 percent. Both figures have returned to their February 2020 pre-pandemic levels. The labor force participation rate, however, was well below the pre-pandemic normal, sitting at 62.1 percent. Overall, the figures from July’s employment report suggest that the labor market remained tight and overheated as demand for labor has returned to normal while supply has stalled in making headway.

Meanwhile, average hourly earnings increased 5.2 percent from a year ago. The growth rate remained unchanged from the previous month and continued to fall behind inflation. While hourly earnings growing at a slower pace than inflation has caused strains on workers’ budget, the growth rate is well above pre-pandemic levels, further adding inflationary pressure on production costs. The wage growth figure, which would be celebrated in any other time, has turned into a paradox in which workers need high wage to compensate for high inflation, but the high wage will push inflation even higher. This means that the Federal Reserve will likely continue to move forward with more rate hikes to ease inflationary pressure.

Employment Picture Returns to Pre-Pandemic Levels

Source: Bloomberg

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| Real GDP Annualized (Q1)(QoQ) | -1.6% | 0.5% | -0.9% |

| University of Michigan Index of Consumer Sentiment (July) | 50 | 51.5 | 55 |

| Nonfarm Payrolls (July)(MoM) | 398K | 250K | 528K |

| Unemployment Rate (July) | 3.6% | 3.6% | 3.5% |

Key Interest Rates

| 8/8/22 | 8/1/22 | Change | |

|---|---|---|---|

| Fed Funds | 2.50% | 2.50% | - - - |

| 1-mo. Libor | 2.39% | 2.37% | 0.02 |

| 3-mo. Libor | 2.91% | 2.80% | 0.11 |

| 2-yr. UST | 3.21% | 2.87% | 0.34 |

| 5-yr. UST | 2.90% | 2.64% | 0.26 |

| 10-yr. UST | 2.75% | 2.58% | 0.17 |

| 30-yr. UST | 2.98% | 2.92% | 0.06 |

Rate Forecast - Futures Market

| Q3-22 | Q4-22 | Q1-23 | Q2-23 | |

|---|---|---|---|---|

| Fed Funds | 3.05% | 3.55% | 3.65% | 3.60% |

| 1-mo. Libor | 2.95% | 3.84% | 3.76% | 3.59% |

| 3-mo. Libor | 3.45% | 3.95% | 3.88% | 3.71% |

| 2-yr. UST | 3.31% | 3.41% | 3.40% | 3.27% |

| 5-yr. UST | 3.33% | 3.34% | 3.29% | 3.20% |

| 10-yr. UST | 3.30% | 3.30% | 3.29% | 3.23% |

| 30-yr. UST | 3.37% | 3.42% | 3.40% | 3.37% |