Eyes on the Economy: Home Prices, Spending, Inflation

Home Prices Rise Again, Driven by Short Supply

Despite rising interest rates, home prices are still elevated. The S&P CoreLogic Case-Shiller 20-City Composite jumped 1.5% (not seasonally adjusted) in March from the previous month, posting an increase for a second straight month and the largest gain since May 2022. The gauge is still lower than a year ago.

The increase in home prices was driven by supply shortages, which more than offset the demand pullback driven by high mortgage rates. As the cost of buying climbs, existing homeowners are deterred from selling their homes and purchasing a new home with higher mortgage rates. This reduces the inventory of existing homes for sale. With lower supplies, home sales have slumped while affordability has become out of reach for many first-time buyers.

Personal Spending Climbs More than Expected

Personal consumption expenditures increased 0.8% in April from a month ago, beating market expectations of 0.4%. Increases in spending were led by big-ticket items such as vehicles. In services, the largest contributors were financial services, health care and professional services. When adjusted for inflation, personal spending increased 0.5%. In both current and adjusted dollars, there were noticeable upticks in spending on goods.

At the same time, personal income grew at 0.4%, or about half of the spending growth rate. Real disposable income—when adjusted for inflation—did not grow at all. The personal savings rate dropped to 4.1% as personal outlays made up nearly 96% of disposable income. That is, consumers spent almost 96% of what they brought home after tax in April. For context, the figure was less than 91% in February 2020.

Fed’s Preferred Inflation Gauge Accelerates

As spending accelerated in April, so did inflation. The Federal Reserve’s preferred gauge for inflation, the Personal Consumption Expenditures Price Index (PCE), accelerated to 4.4% on a year-over-year basis in April, compared with 4.2% in the previous month. When excluding food and energy, the index increased 4.7% from a year ago. PCE prices for goods rose 2.1%, an acceleration from March’s 1.6% advance. Prices for services grew at the same pace as in March at 5.5%. =

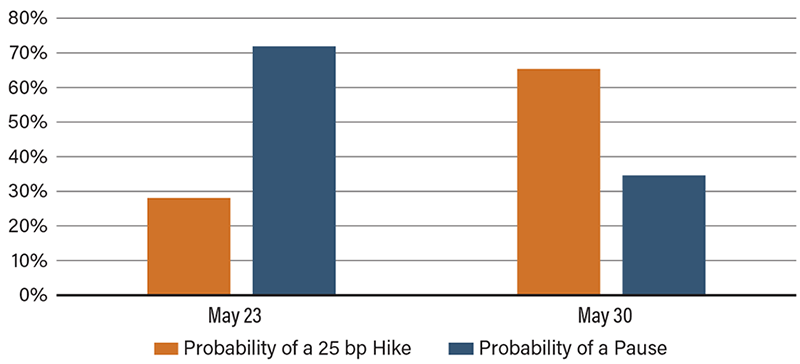

As mentioned in the personal spending report, there was a noticeable increase in spending on goods, which was reflected in inflation of goods. There’s a direct link between personal spending and inflation. Many hold a contradictory view, celebrating high consumer spending and yet hoping for inflation to come down so the Fed will pause and then cut interest rates. The Fed is not going to cut rates if inflation continues to be persistent. Inflation will continue to be persistent if consumer spending continues to be persistent. In fact, with the acceleration in personal spending and PCE inflation, market-implied probability of another 25-basis-point interest rate hike in June is now above 65%.

Probability of a June 14 Fed Funds Rate Hike

Source: Trading Economics.

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| S&P CoreLogic Case-Shiller 20-City Home Price Index (Mar.)(MoM) | 0.3% | 0.4% | 1.5% |

| Personal Consumption Expenditures (Apr.)(MoM) | 0.1% | 0.4% | 0.8% |

| Personal Income (Apr.)(MoM) | 0.3% | 0.4% | 0.4% |

| PCE Price Index (Apr.)(YoY) | 4.2% | 4.3% | 4.4% |