Eyes on the Economy: Homebuilder Sentiment, Geopolitical Tensions

Homebuilder Sentiment Declines, Remains Strong

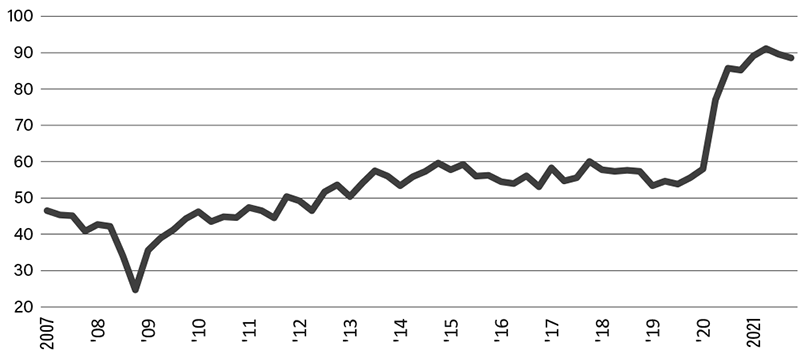

Homebuilder sentiment declined for a second consecutive month, but remains well above the 50-point threshold marking good short-term building conditions.

Demand remains strong and stems from positive demographic trends. Millennials have entered their 30s—their prime homebuying years.

Although mortgage rates have edged higher, they continue to be relatively low compared to historical rates. The short-term outlook remains positive for homebuilding with the S&P CoreLogic national composite index up 0.9% from the prior month, along with a robust boost in housing starts.

Supply-chain issues remain problematic and continue to delay new home deliveries, adding to the backlog of new-home construction projects. The share of homes for sale that are not complete has fallen to near an all-time low in recent months.

Material shortages also increase costs, weighing on affordability. While demographics will keep demand from evaporating, demand will slow in the short term due to increased home prices.

Additionally, the Federal Reserve is expected to raise interest rates by 25 basis points three times this year, pushing up mortgage rates. Higher mortgage rates will lower buyers’ purchasing power. As a result, first-time homebuyers—where the bulk of demand currently lies—may be priced out of the market.

The main risks to the forecast include a larger than expected rate hike—investors expecting six rate hikes versus the Federal Reserve’s indication of three—and further acceleration in house price appreciation. In both cases, affordability would decline more quickly and weigh on new-home demand and sales. Supply-chain issues also could persist longer than initially predicted, extending construction timelines.

Geopolitical Tensions Weighing on Consumer Psyches

U.S. consumer confidence came in slightly worse than anticipated in February, marking two months in a row of declines. The Conference Board’s consumer sentiment index fell from 111.1 in January to 110.5 in February.

Consumers’ assessment of present conditions improved, but expectations soured. The slight decline in confidence comes as geopolitical risk is rearing its ugly head, adding to an already-challenging backdrop of pandemic recovery and high inflation. Inflation has become the No. 1 threat to the U.S. economy.

The U.S. economy needs a long expansion to allow the labor market to continue to heal, help reduce the $30 trillion of national debt built up due to two recessions in the past 15 years, and bringing inflation down near the Federal Reserve’s threshold of 2 percent.

This is easier said, than done. Geopolitical risks—and higher oil prices, specifically—could complicate matters for the Federal Reserve as it tries to stem the tide of rising prices and guide the economy to a soft landing.

National Association of Home Builders Housing Market Index

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| NAHB/Wells Fargo Housing Market Index (Feb.) | 83 | 82 | 82 |

| Housing Starts | 1,702K | 1,750K | 1,899K |

| S&P CoreLogic Case-Shiller (Dec.) YoY | 18.81% | 18.10% | 18.84%% |

| Conference Board Consumer Confidence (Feb.) | 113.8 | 110.0 | 110.5 |

Key Interest Rates

| 2/22/22 | 2/14/22 | Change | |

|---|---|---|---|

| Fed Funds | 0.25% | 0.25% | -- |

| 1-mo. Libor | 0.18% | 0.13% | 0.05 |

| 3-mo. Libor | 0.49% | 0.46% | 0.03 |

| 2-yr. UST | 1.56% | 1.58% | (0.02) |

| 5-yr. UST | 1.85% | 1.90% | (0.05) |

| 10-yr. UST | 1.94% | 1.98% | (0.04) |

| 30-yr. UST | 2.24% | 2.29% | (0.05) |

Rate Forecast - Futures Market

| Q1-22 | Q2-22 | Q3-22 | Q4-22 | |

|---|---|---|---|---|

| Fed Funds | 0.50% | 0.85% | 1.10% | 1.35% |

| 1-mo. Libor | 0.18% | 0.49% | 0.77% | 0.97% |

| 3-mo. Libor | 0.48% | 0.79% | 1.07% | 1.27% |

| 2-yr. UST | 1.27% | 1.44% | 1.57% | 1.69% |

| 5-yr. UST | 1.71% | 1.83% | 1.91% | 1.99% |

| 10-yr. UST | 1.90% | 2.03% | 2.12% | 2.21% |

| 30-yr. UST | 2.23% | 2.35% | 2.43% | 2.52% |