Eyes on the Economy: Housing, Consumer Confidence, Labor Market

Housing Market Continues To Decline

It is no mystery that the housing sector is one of the most sensitive to interest rates. As the Federal Reserve’s policy rate continues to climb, the housing market consequently declines. The Pending Home Sales Index, a leading indicator measuring housing sale contracts, dropped 37 percent in October from a year ago, marking the sharpest yearly decline on record. On a month-over-month basis, the index fell 4.6 percent for a fifth consecutive decline.

The latest FHFA House Price Index, which measures changes in average prices of single-family houses with mortgages guaranteed by Fannie Mae and Freddie Mac, increased 11 percent in September from a year ago. This is the smallest increase since October 2020—marking a consistent deceleration but not a decline. Overall, we are seeing buyers deterred by high interest rates, but prices, while decelerating, have not returned to pre-pandemic levels.

Consumer Confidence Drops

The Conference Board reported another decline of its Consumer Confidence Index, which fell to 100.2 in November from 102.2 in October. After some improvement, consumer confidence declined for a second consecutive month, most likely prompted by a rise in gasoline prices, according to the Conference Board.

Although consumers were more optimistic about the current job market, their short-term outlook was more downbeat. Their assessment of the current business conditions also became more pessimistic. The sub-index for expectations—based on short-term outlook for income, business and labor market conditions—also declined.

Inflation expectations reached the highest level since July as consumers anticipate high prices of gas and food this holiday season. Overall, the Conference Board expects inflation and high interest rates to weigh on growth in 2023.

Labor Market Casts Trouble for the Federal Reserve

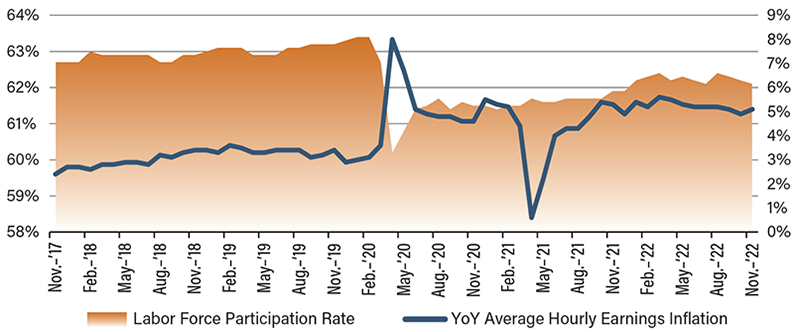

Once again beating market forecasts, the U.S. economy added 263,000 jobs in November. Although it is the lowest gain since April 2021, the figure follows an expected pattern of normalization after a pandemic shock. The biggest hurdle lies in wage inflation driven by widespread labor shortages. After a brief period of deceleration, the average hourly earnings accelerated again, rising 5.1 percent from a year ago. The inflation of average hourly earnings has run over 5 percent in every month but October this year.

The rising wage reflects persistent worker shortages in a labor market where participation has struggled to recover since the pandemic. The labor force participation rate further edged down slightly from 62.2 percent to 62.1 percent, marking marginal but consistent declines for four consecutive months. The unemployment rate remained at a near-historic low of 3.7 percent despite the deceleration of job gains.

The tight labor market, which has been more resistant to rate hikes, suggests trouble for the Fed. With rising wages adding to production cost, particularly in the services sector—which has overtaken core goods in driving current inflation—the Fed will need to do more to curb wage growth and restore price stability.

Wage Inflation Runs High When Labor Force Participation Rate Is Low

Source: Federal Reserve Bank of Chicago

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| Pending Home Sales (Oct)(YoY) | (30%) | (24%) | (37%) |

| Consumer Confidence (Nov) | 102.2 | 100.0 | 100.2 |

| Nonfarm Payrolls (Nov)(MoM) | 284K | 200K | 263K |

| Labor Force Participation Rate (Nov) | 62.2% | 62.2% | 62.1% |

Key Interest Rates

| 12/5/22 | 11/28/22 | Change | |

|---|---|---|---|

| Fed Funds | 4.00% | 4.00% | -- |

| 1-mo. Libor | 4.22% | 4.07% | 0.15 |

| 3-mo. Libor | 4.72% | 4.73% | (0.01) |

| 2-yr. UST | 4.40% | 4.44% | (0.04) |

| 5-yr. UST | 3.79% | 3.88% | (0.09) |

| 10-yr. UST | 3.59% | 3.68% | (0.10) |

| 30-yr. UST | 3.59% | 3.72% | (0.13) |

Rate Forecast - Futures Market

| Q4-22 | Q1-23 | Q2-23 | Q3-23 | |

|---|---|---|---|---|

| Fed Funds | 4.50% | 5.00% | 5.00% | 4.90% |

| 1-mo. Libor | 4.33% | 4.96% | 5.10% | 4.98% |

| 3-mo. Libor | 4.83% | 5.18% | 5.24% | 5.11% |

| 2-yr. UST | 4.56% | 4.56% | 4.36% | 4.08% |

| 5-yr. UST | 4.29% | 4.29% | 4.10% | 3.86% |

| 10-yr. UST | 4.03% | 4.01% | 3.89% | 3.74% |

| 30-yr. UST | 4.17% | 4.12% | 4.00% | 3.88% |