Eyes on the Economy: Housing, Credit Cards, Inflation

Housing Market Index Falls in August

After making a comeback from its declines last winter, the housing market expansion stalled in August. The National Association of Home Builders Housing Market Index unexpectedly fell to 50, a reading that indicates neither contraction nor expansion, and below the forecast figure of 56. The sub-index for single-family home sales decreased to 57, from 62 in the previous month, while the sub-index for prospective buyers dropped to 34, a 6-point decline from July. Home builder confidence also decreased after reporting an upbeat sentiment last month. Overall, the movements of the index in the past 12 months show how volatile and fragile the market is in this rising-rate environment.

Credit Cards Push Household Debt to New Record

U.S. total household debt reached a new record of $17.06 trillion in the second quarter, an increase of $16 billion from the previous quarter. All debt categories—except mortgage and student loans—posted an increase. Mortgage debt decreased by $30 billion, largely thanks to declining mortgage originations. Meanwhile, student loan balances dropped $35 billion as a result of some debt-forgiveness programs and the timing of the academic year, as new student loans aren’t typically originated in the second quarter.

Auto loan balances, on the other hand, jumped $20 billion, following an upward trajectory since 2011. Although the number of newly originated loans remained below pre-pandemic levels, the volume was higher due to higher auto prices. Most concerning, however, is the new record set by credit card debt, which surpassed $1 trillion for the first time. New York Federal Reserve researchers continue to insist that “there is little evidence of widespread financial distress for consumers” despite the fact that credit card debt continued to set new records and delinquencies are at an 11-year high, while the personal saving rate is far below pre-pandemic levels.

Producer Inflation Accelerated in July

The Annual Producer Price Index (PPI) accelerated to 0.8% in July from 0.2% in June. On a monthly basis, it accelerated 0.3% after falling flat in June. Core PPI—excluding food and energy—accelerated to a monthly rate of 0.3%, after declining 0.1% in June, and remained the same as June when measured on a yearly basis. Producer prices in services were up 0.5%, the largest monthly rise since August 2022. Annually, producer prices in services went up 2.5%, accelerating from 2.3% in June.

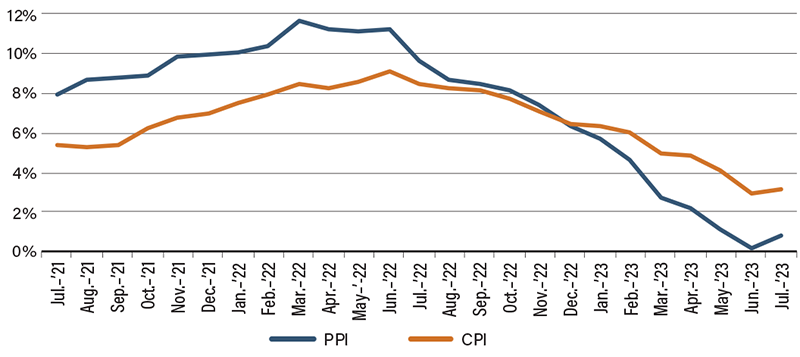

The pattern in headline PPI is consistent with the pattern in Consumer Price Index (CPI), as both had decelerated since June 2022 but picked up again in July. What is vastly different between the two is the speed at which each index decelerated. Evidently, producer inflation decelerated much faster than consumer inflation in 2023. Between 2021 and 2022, prices were rising much faster for producers than consumers. This could be easily explained by supply chain pressures. Businesses were able to pass on portions of their rising costs to consumers. CPI was high, but remained lower than PPI during that period; this year, however, CPI overtook PPI. This suggests that consumer inflation is stickier than producer inflation.

Producer Inflation Decelerating Faster than Consumer Inflation

Source: Trading Economics.

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| NAHB Housing Market Index (Aug.) | 56 | 56 | 50 |

| Total Household Debt (Q2 2023) | $17.05T | N/A | $17.06T |

| Credit Card Debt (Q2 2023) | $0.99T | N/A | $1.03T |

| Producer Price Index (Jul.)(YoY) | 0.2% | 0.7% | 0.8% |