Eyes on the Economy: Housing, Jobs, GDP

Unaffordability Persists in the Housing Market

Existing-home sales experienced a notable dip of 5.9% in March, settling at a seasonally adjusted annual rate of 4.02 million, marking a 2.4% decrease from the previous year. Meanwhile, the median price for existing (single-family and condo) homes surged 2.7% from March 2024, hitting a record $403,700 last month and continuing a 21-month streak of year-over-year price growth. The inventory of unsold existing homes increased 8.1% from the prior month, reaching 1.33 million by the end of March. This equals a four-month supply at the current sales pace if no new inventory is added.

The S&P CoreLogic Case-Shiller National Home Price Index, which measures single-family home prices, increased 3.9% year-over-year in February, marking a deceleration from January’s annual rate gain of 4.1%. On a month-over-month basis, single-family home prices rose 0.3%.

Job Openings Decline

U.S. job openings decreased by 288,000 to 7.192 million in March, marking a six-month low and falling short of the anticipated 7.48 million openings. Significant drops occurred in transportation, warehousing, utilities, accommodation and food services, construction, federal government, real estate/rental and leasing, and health care and social assistance. Conversely, job openings rose in finance and insurance, other services, state and local education, wholesale trade and manufacturing.

Regionally, openings decreased in the Northeast, South and West but increased in the Midwest. New hires remained at 5.4 million, while total separations stayed around 5.1 million, with the number of quits stable at 3.3 million and layoffs/discharges slightly down at 1.6 million. Overall, the labor market is experiencing a “no hiring, no firing” period where employers are not looking to increase head count but also not ready to make mass layoffs.

GDP First Estimate Reveals Economy Contracted

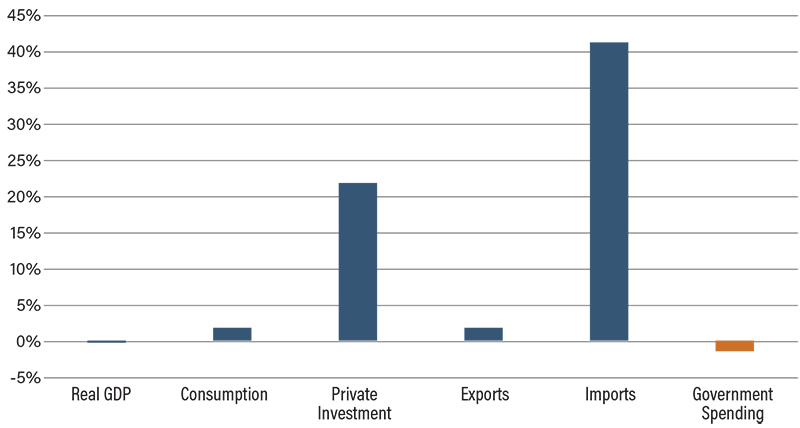

Real gross domestic product (GDP) declined 0.3% in the first quarter, according to the first estimate released by the U.S. Bureau of Economic Analysis. One of the driving factors for the contraction is the rise in imports, which subtracted nearly 5 percentage points from GDP as consumers and companies rushed to purchase goods from abroad before tariffs take effect. Another driver is the decline in government spending. Although there were upticks in exports and investment, consumer spending decelerated and did not make enough gain to offset the subtraction by exports and government spending.

Consumer spending, which has carried the economy—single handedly in some quarters—slowed drastically from 4% in the last quarter of 2024 to just 1.8% in the first quarter of 2025, the weakest posting since mid-2023. This reflects recent data on consumer confidence and sentiment, which have dropped very quickly over the past two months. Fears of tariff-induced inflation are a main driving force of declining consumer confidence. The Personal Consumption Expenditures (PCE) price index accelerated to 3.6% in the first quarter from 2.4% in the last quarter of 2024. Meanwhile, economists are seeing rising odds of a recession over the next 12 months.

Percentage Change of GDP Components, Q0Q

Source: U.S. Bureau of Economic Analysis.

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| Existing-Home Sales (Mar.)(MoM) | 4.4% | (3%) | 5.9% |

| S&P CoreLogic Case-Shiller Home Price Index (Feb.)(YoY) | 4.1% | N/A | 3.9% |

| JOLTs Job Openings (Mar.) | 7.48M | 7.48M | 7.19M |

| Real Gross Domestic Product (Q1)(QoQ) | 2.4% | 0.3% | (0.3%) |