Eyes on the Economy: Industrial Production, Homebuilder Sentiment, Inflation

Industrial Production Climbs in January

Industrial production in the United States increased 2% year-over-year in January, the largest gain since October 2022. The rise was largely driven by a big jump of 6.9% year-over-year in utilities, driven by high demand for heating due to cold temperatures. Manufacturing posted a relatively small gain of 1% on a year-over-year basis, but declined 0.1% on a monthly basis, held down by a 5.2% decline in motor vehicles and parts.

Capacity utilization, which measures how well the industrial sector reaches its potential, edged up to 77.8% in January from 77.5% in December. The indicator is still 1.8 percentage points below its long-run (1972–2024) average.

Homebuilder Sentiment Drops to Five-Month Low

The National Association of Home Builders (NAHB) Housing Market Index dropped to 42 in February from 47 in January, the lowest reading in five months. The decrease erased January’s gains driven by the initial optimism over the new administration.

Homebuilder sentiment turned sour with increased concerns about tariffs, elevated mortgage rates and high costs. The subindex for current sales conditions fell four points to 46 while future sales expectations plunged 13 points to 46. Although builders hold out hope for pro-development policies, uncertainty about tariffs pushed down their expectations for future sales volume to the lowest level since December 2023.

About 32% of appliances and 30% of softwood lumber come from abroad, according to NAHB Chief Economist Robert Dietz. Shelter cost, which drives the majority of inflation, depends largely on the economy’s ability to add more housing supply to curb further inflation. The prospect of higher cost for homebuilding poses challenges to fighting inflation.

Inflation Continues To Stick Around

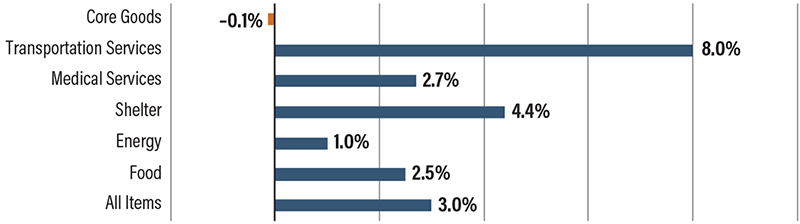

The Consumer Price Index (CPI) inflation rate ticked up to 3% in January from 2.9% in December, marking the fourth consecutive month of rising prices. Energy rose 1% year-over-year, the first increase in six months. Although shelter inflation slightly slowed, it still accounted for the majority of the overall CPI inflation rate. On the wholesale side, the Producer Price Index inflation rate came out at 3.5% in January, the same as December, but ahead of market expectations of 3.2%.

Overall, inflation appears to be on track to return. While CPI inflation has been rising over the past four months, the question is whether or not it is a trend or a blip. Federal Reserve officials still mostly insist that inflation is on the right track, although they admit the risk is to the upside. Meanwhile, there are still many inflationary forces—from previous stimulative policy that’s still working in the economy to new inflationary forces such as tariffs. However, potential disinflationary forces may be emerging as multiple natural disasters, such as the wildfires and floods that have hit the U.S. this year, and the mass firing of federal employees—which make up a large fraction of the U.S. workforce—could hit consumer spending before we even know it.

Price Changes for Key CPI Components (Year-Over-Year)

Source: U.S. Bureau of Labor Statistics.

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| NAHB Housing Market Index (Feb.) | 47 | 47 | 42 |

| Industrial Production (Jan.)(YoY) | 0.3% | 0.9% | 2.0% |

| Consumer Price Index (Jan.)(YoY) | 2.9% | 2.9% | 3.0% |

| Producer Price Index (Jan.)(YoY) | 3.5% | 3.2% | 3.5% |