Eyes on the Economy: Industrial Production, Housing, Interest Rates

Industrial Production Sees First Decline in two Years

U.S. industrial production decreased 0.2% in February from a year ago, marking the first decline in two years. On a month-over-month basis, the gauge made no gain at all, missing the market forecast of 0.2% growth. Industrial production measures business output in the industrial sector, with manufacturing accounting for 78% of total output. The year-over-year decline is driven by a drop of 7.6% in utilities and 1% in manufacturing. Meanwhile, capacity utilization remained unchanged from January at a two-year low of 78%, 1.6 percentage points below its long-run average. Capacity utilization is the rate at which potential output levels are being met or used.

There are two important points to take away from the reported figures above. First, capacity utilization is a leading indicator of consumer price inflation—a lower utilization rate indicates higher prices ahead. Second, industrial production is a coincident indicator of a business cycle. That is, a decline typically happens coincidently with an economic downturn—in other words, a recession.

Housing Starts Pick Up

Despite all that is going on with rising interest rates, housing starts increased to 1.45 million in February, the highest number in five months. The seasonally adjusted annualized figure beat market forecasts of 1.31 million. Nonetheless, housing starts were still 18.4% lower than the same month last year. Similarly, building permits also increased in February to 1.524 million, posting a 13.8% increase from January. This, too, was the highest reading in five months and beat market expectations.

Housing starts and building permits are indicators of future availability of homes and other types of real estate units. The significant surges in both indicators are signs of renewed developer confidence in the real estate market in the upcoming future.

The Federal Reserve Continues Its Rate Hikes Despite Banking Tumult

Arguably the most-watched interest rate decision of the current tightening cycle is in. The Federal Open Market Committee (FOMC) raised its target policy rate 25 basis points, bringing the rate to 5%. Despite recent events in the banking sector, the central bank decided to continue to raise interest rates and suggested that more action could be “appropriate” if prices continue to climb. However, it must be noted that only days before the recent bank collapses, we were looking at a high market-implied probability of a 50-basis-point hike at this meeting. There is an implied impact of the current banking sector risk on the decision to forego a larger hike and instead move forward with a smaller hike. The key takeaway from this decision is that the Fed views price stability as the primary goal of its monetary policy, whereas financial stability risk, although taken into consideration, is a secondary goal.

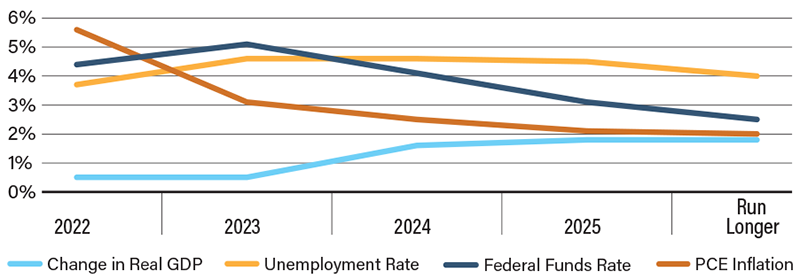

At this meeting, the FOMC also released its economic projections. The unemployment rate is projected to rise to 4.6% this year and then decline to 4% the following year. Its preferred measure for inflation, the Personal Consumption Expenditures Index, is expected to decelerate to 3.5% by the end of this year. Meanwhile, the median projection for the appropriate policy rate this year is 5.1%.

FOMC March 2023 Economic Projections

Source: U.S. Bureau of Labor Statistics.

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| Industrial Production (Feb.)(MoM) | 0.3% | 0.2% | 0.0% |

| Capacity Utilization (Feb.) | 78.0% | 78.4% | 78.0% |

| Housing Starts (Feb.) | 1.321M | 1.31M | 1.45M |

| Fed Funds Rate | 4.75% | 5.00% | 5.00% |