Eyes on the Economy: Industrial Production, Retail Sales, Housing

Industrial Production Declines for Second Straight Month

U.S. industrial production dropped 0.7% in October from a year ago, posting a second straight month of annual declines. On a monthly basis, production decreased 0.6%. Output fell in all major market groups. Manufacturing saw the biggest drop, posting a decrease of 0.7% month-over-month and 1.7% year-over-year. October’s decline was largely driven by a 10% drop in motor vehicles and parts due to the recent labor strikes. Utilities output fell 1.6% while mining increased 0.4% month-over-month. On a yearly basis, both posted increases.

Capacity utilization, the rate at which potential output levels are being met or used, decreased to 78.9%. While this figure is 0.8 percentage point below the long-run average, it is not yet at a concerning level.

Retail Sales End Six-Month Streak of Increases

Retail sales fell 0.1% month-over-month in October after six straight months of gains as purchases on motor vehicles and hobbies declined. On a year-over-year basis, however, retail sales are 2.5% higher than October 2022. Overall, the data suggest a potential turning of the economy that was refueled in the summer.

Producer prices posted the biggest decline in more than three years on a month-over-month basis as gasoline prices dropped. Similar moderating data were also observed in consumer prices and the labor market, suggesting the last quarter of 2023 kicked off with much-needed cooling.

Although many expect gains in retail sales to be smaller this holiday season, there is still a lot of uncertainty as much of the October slowdown was thanks to lower energy prices. Oil prices are expected to remain low for the coming months, but nothing is set in stone, particularly for prices of this volatile category.

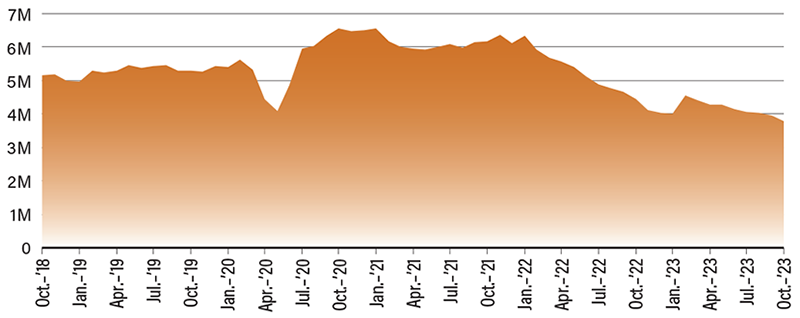

Existing-Home Sales Hit Lowest Point Since August 2010

Existing-home sales dropped 4.1% in October to a seasonally adjusted annualized rate of 3.79 million units, marking the lowest level since August 2010. Sales declined in all but two months this year. When mortgage rates stay elevated while prices do not decline to offset the increased mortgage cost, buyers are priced out. At the same time, inventory remains low as existing homeowners with cheap mortgages are not selling. Both forces have kept sales low and homeownership unaffordable.

Building permits, a key leading indicator of construction, have fallen back from 2022 levels. Housing starts, a leading indicator of how many new homes will be available in the market, is still struggling to meet demand. As the supply of the resale market remains limited, there has been a boost in new construction. Nonetheless, this has not been sufficient to increase supply enough to tame price growth. Homebuilders are still facing challenges posed by limited supplies of materials, labor and land.

Even if mortgage rates were to come down in the near future, affordability remains a big question as home prices remain stubbornly high. There is also the potential upward pressure on prices if mortgage rates decline as demand may be refueled without supply to match. The affordability crisis does not seem to have an end in sight as the issue has been ignored for so long while no viable solution has been proposed.

Existing Home Sales Continue To Decline

Source: National Association of Realtors.

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| Industrial Production (Oct.)(MoM) | 0.1% | (0.3%) | (0.6%) |

| Manufacturing Production (Oct.)(MoM) | 0.2% | 0.0% | (0.7%) |

| Retail Sales (Oct.)(MoM) | 0.9% | (0.3%) | (0.1%) |

| Existing Home Sales (Oct.) | 3.95M | 3.90M | 3.79M |