Eyes on the Economy: Inflation, Employment Costs, GDP

PCE Gauge Slows in June

The Personal Consumption Expenditures (PCE) Price Index increased 3% in June from a year ago, the slowest annual jump since March 2021. The deceleration was driven by declines of 18.9% in energy prices and 0.6% in goods prices. Meanwhile, prices of services continued to rise—up 4.9% from a year ago. Food prices increased at an annual rate of 4.6%. On a month-over-month basis, headline PCE accelerated to 0.2%, up from 0.1% in May, while core PCE eased from 0.3% to 0.2%.

For the same period, personal income grew at a monthly rate of 0.3%, decelerating from 0.5% in the previous month and falling short of market expectations of 0.5%. The growth was driven by employment compensation, which was partly offset by a decline of personal income receipts from assets. Overall, the deceleration in both inflation and income points to possible cooling on the consumption side.

Employment Costs Ease

Compensation cost for civilian workers grew 1% in the second quarter, decelerating from a 1.2% growth rate in the first quarter. Despite the easing, cost growth remained well above its pre-COVID levels. For the 12-month period ending June 2023, employment cost increased 4.6%, easing from a 5.3% increase in the 12-month period ending in June 2022. The growth was led by increases in service-providing industries such as healthcare and social assistance. While employment cost pressure has been modestly easing in both goods- and service-providing sectors, pressure remained higher for services.

Taken into consideration with all other price indicators, there’s an overall trend in modest cooling of inflationary pressure. However, compensation cost has been a key driver of inflation. With other inflation inputs—such as supply chain pressure and energy price shock—fading, cost pressure from employment compensation is at the center of the battle against inflation.

GDP Growth Unexpectedly Accelerates in Q2

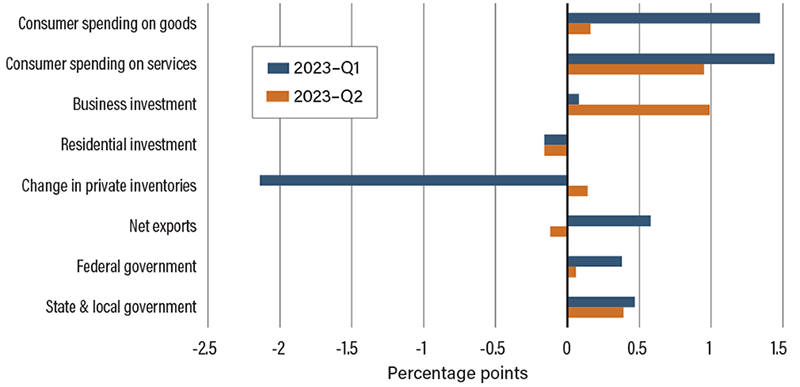

U.S. real gross domestic product (GDP) increased 2.4% in the second quarter, well above consensus forecasts of 1.8%. The unexpected acceleration was driven by growth in business investment, change in inventory and consumption.

Change in inventory is typically a volatile account; therefore, one quarter of growth or decline is less indicative than other accounts. The dramatic growth in business investment, on one hand, tells a significant story, especially in a rising-rate environment where lower or declining investment should be expected. The gain in business investment contributed 1 percentage point to the 2.4% growth—that is, it’s responsible for over 40% of the growth, which is unusual. Despite higher interest rates, investment in electric vehicle factories and chip-manufacturing plants was fueled by fiscal policy such as the Chip and Science Act and the Inflation Reduction Act. The easing supply chain pressure also helped drive investment in equipment.

And finally, consumption—although it still added to GDP growth—significantly decelerated. Its contribution to growth declined from 2.78 percentage points in the first quarter to 1.11 percentage points in the second quarter. Overall, the unexpected part of the second quarter’s growth is the large increase in business investment.

Contribution to Real GDP Growth

Source: Trading Economics.

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| Personal Consumption Expenditure (Jun.)(YoY) | 3.8% | 3.0% | 3.0% |

| Personal Income (Jun.)(MoM) | 0.5% | 0.5% | 0.3% |

| Employment Cost (Q2 2023)(QoQ) | 1.2% | 1.1% | 0.9% |

| Real GDP Growth, Annualized (Q2 2023)(QoQ) | 2.0% | 1.8% | 2.4% |