Eyes on the Economy: Inflation, Home Sales, Manufacturing

Inflation Rate Softens

There’s slightly good news for the economy: The Personal Consumption Expenditures Price Index—the Federal Reserve’s preferred inflation gauge—softened in May. The deceleration was seen in both year-over-year (3.8%) and month-over-month (0.1%) bases, as well as both headline and core—excluding food and energy—measures. However, it must be noted that core inflation has been consistently stickier than headline prices. The core annual measure marginally moved from 4.7% in April to 4.6% in May while the headline figure decelerated by 5 percentage points over the same period.

While the overall slowing down of inflation provides some sense of relief, concerns about the stubbornness of core inflation remain a key factor in the Fed’s interest rate decisions. The marginal changes in core inflation data suggest the central bank still has more work to do.

Pending Home Sales Continue To Decline

While home prices remain elevated despite some softening, pending home sales decreased 22.2% in May from a year ago. This marks the 24th consecutive month of declines. Although higher mortgage rates have driven down demand to some extent, the falling home sales more reflect supply shortages, which is why home prices have been stubbornly high.

With rising interest rates, existing homeowners are deterred from selling their homes, which are locked down with low mortgage rates. No one wants to purchase their next home at the currently higher rates. In this aspect, the current interest rate environment pulls down supply much more than it does demand, resulting in an equilibrium where supply has an upper hand. It is estimated that each listing receives an average of three offers, clearly indicating a market where demand far exceeds supply.

Manufacturing Drops to Lowest Level in Three Years

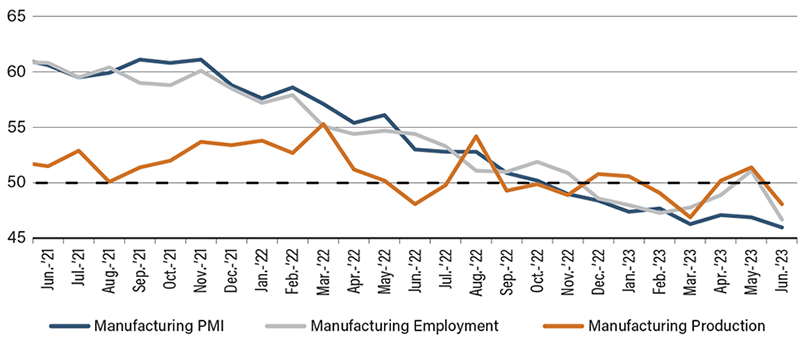

The Institute for Supply Management (ISM) Manufacturing Purchasing Managers Index declined to 46 in June, its lowest level since May 2020. Note that a reading of below 50 indicates a contraction. The index has been running below 50 since November 2022, suggesting that activity in the manufacturing sector has contracted for eight straight months.

There was indication that supply chain pressure further improved as supplier deliveries were faster, the backlog of orders decreased and supply price pressure eased. The impact of COVID-19, which blurred the real declines in manufacturing for some time as explained in an April issue of Solutions, is fading while contraction in the sector’s activity becomes clearer. Unfortunately, this means that the factor that helped delay layoffs is diminishing.

Most noteworthy is the employment sub-index, which contracted sharply in June. As noted by ISM Chair Timothy Fiore, “Demand remains weak, production is slowing due to lack of work and suppliers have capacity. There are signs of more employment reduction actions in the near term.” Expect the sector’s recessionary environment to become clearer in the coming months.

Manufacturing Business Activity

Source: U.S. Census Bureau.

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| PCE (May)(YoY) | 4.3% | 3.9% | 3.8% |

| Core PCE (May)(YoY) | 4.7% | 4.7% | 4.8% |

| Pending Home Sales (May)(YoY) | (20%) | (17%) | (22%) |

| ISM Manufacturing PMI (Jun.) | 46.9 | 46.0 | 47.0 |