Eyes on the Economy: Inflation, Industrial Production, Consumer and Homebuilder Sentiment

Inflation Cools; Risk Remains

The Consumer Price Index increased 0.2% month-over-month in February, following a 0.5% rise in January. Overall, it shows a moderate slowing from the previous month. On a year-over-year basis, the index increased 2.8%, compared with 3% in January. Shelter inflation, which is the largest contributor to the index, slowed to 4.2% from 4.4%.

Meanwhile, food inflation accelerated to 2.6% from 2.5%. Gasoline posted deflation of 3.1% but was offset by increases in electricity and natural gas prices. Excluding food and energy, core inflation rose 3.1%, the smallest increase since April 2021. Core services, including shelter, remain the largest driving factor of inflation.

While the slight moderation of inflation may provide some sense of relief for observers, the U.S. saw lower inflation rates in August 2024 and the following few months, only to see inflation trend up again. The impact of tariffs on prices and inflation has not been seen yet but should be expected in the near future.

Utilities Perform Well, Boost Industrial Production

U.S. industrial production saw a notable increase of 0.7% month-over-month in February, surpassing the expected 0.2% rise. On a year-ago basis, industrial production grew 1.4%. The growth was primarily driven by the utilities sector's strong performance, which was the result of increased demand for heating due to the extreme winter weather.

Although manufacturing showed signs of recovery, it was likely driven by an overdue bounce in auto manufacturing as well as a race to produce goods before tariffs take effect. This growth is unlikely to be sustained. Meanwhile, the mining sector’s industrial production rose 2.8% month-over-month in February after a decline of 3.2% in January. Compared with a year ago, the sector stagnated with no growth.

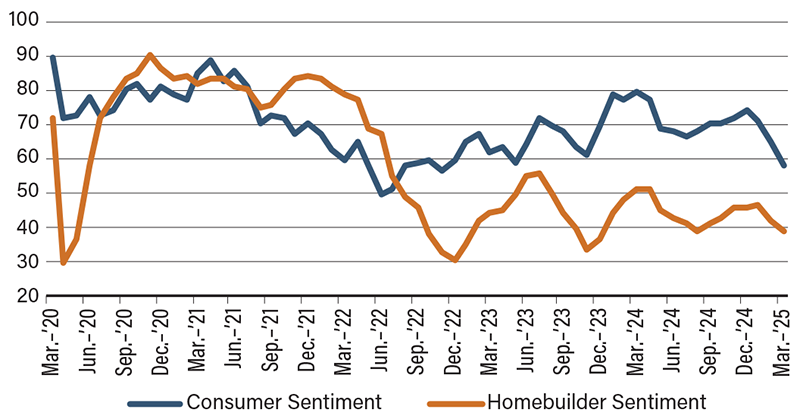

From Consumers to Homebuilders, Sentiment Declines

The University of Michigan Consumer Sentiment Index dropped to 57.9 in March, representing a 10.5% decline from last month. The deterioration of consumer sentiment was seen across political affiliations—all in agreement that economic outlook has weakened since February, according to the consumer survey. The subindex for consumer expectations fell 10% for Republicans, 24% for Democrats and 12% for independents. The one-year inflation expectations rose to 4.9%, the highest level since November 2022. Meanwhile, inflation expectations for the five-year horizon spiked to 3.9%, the highest reading since February 1993.

Consumers aren’t alone in turning gloomy on the economy and inflation. The National Association of Home Builders Housing Market Index came out at 39 in March, the lowest reading in seven months. Builders reported elevated building material costs exacerbated by threats of tariffs and other challenges such as shortages of lots and labor. Although sales expectations remained steady, prospective buyer traffic fell five points. However, builders reported some relief on the regulatory side. Overall, economic uncertainty, inflation and tariff threats proved to be stronger forces in pulling down homebuilder sentiment.

Consumer, Homebuilder Sentiment Declines

Source: Trading Economics.

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| Consumer Price Index (Feb.)(YoY) | 3.0% | 2.9% | 2.8% |

| Industrial Production (Feb.)(YoY) | 1.9% | 2.3% | 1.4% |

| University of Michigan Consumer Sentiment (Mar.) | 64.7 | 63.1 | 57.9 |

| NAHB Housing Market Index (Mar.) | 42 | 42 | 39 |

Key Interest Rates

| 3/17/25 | 3/10/25 | Change | |

|---|---|---|---|

| Fed Funds | 4.50% | 4.50% | --- |

| 2-yr. UST | 4.05% | 3.90% | 0.15 |

| 5-yr. UST | 4.10% | 3.97% | 0.13 |

| 10-yr. UST | 4.31% | 4.21% | 0.10 |

| 30-yr. UST | 4.60% | 4.54% | 0.06 |

Rate Forecast — Futures Market

| Q2-25 | Q3-25 | Q4-25 | Q1-26 | |

|---|---|---|---|---|

| 4.25% | 4.00% | 4.00% | 3.75% | |

| 4.05% | 3.95% | 3.85% | 3.75% | |

| 4.25% | 4.15% | 4.10% | 4.05% | |

| 4.40% | 4.40% | 4.35% | 4.25% | |

| 4.65% | 4.60% | 4.60% | 4.55% |