Eyes on the Economy: Inflation, Trade, Sentiment

Inflation Eases for a Second Consecutive Month

The Consumer Price Index (CPI) slowed to an annual rate of 2.4% in March from 2.8% in February, the lowest post since September 2024 and well below the forecast of 2.6%. The deceleration was largely driven by falling oil prices and moderating shelter inflation. On a month-to-month basis, CPI decreased 0.1%, the first monthly decline since May 2020 and below expectations of 0.1% gain.

Core CPI—excluding food and energy—also slowed to an annual rate of 2.8% in March from 3.1% February, marking the lowest rate since March 2021. This was driven by moderating shelter inflation and significantly slower transportation services inflation. As air travel has taken a hit due to recent international tensions and air incidents, airfares fell 5.3% in March, following a 4% decline in February. Tariffs are not captured in March data.

Import, Export Inflation Slows

Export prices increased 2.4% in March from a year ago, slower than the annual price increase of 2.6% in February. On a month-over-month basis, export prices were unchanged while agricultural export prices posted no growth and nonagricultural export prices declined 0.1%. Meanwhile, import prices increased 0.9% year-over-year in March, slower than the price increase of 1.6% in February. On a month-over-month basis, import prices decreased 0.1%. The decline was driven by lower prices for fuel imports, which more than offset the increase in nonfuel imports. Both import and export prices reported do not include tariffs.

The global decline in oil prices played a significant role in driving down inflation, which was reflected in both CPI and import and export prices. As the world economy is expected to slow, global demand for oil—especially from China, the largest consumer of oil—is slowing and driving down prices. This more than offset price increases in natural gas and electricity.

Sentiment Index Shows Consumers Are Even Gloomier

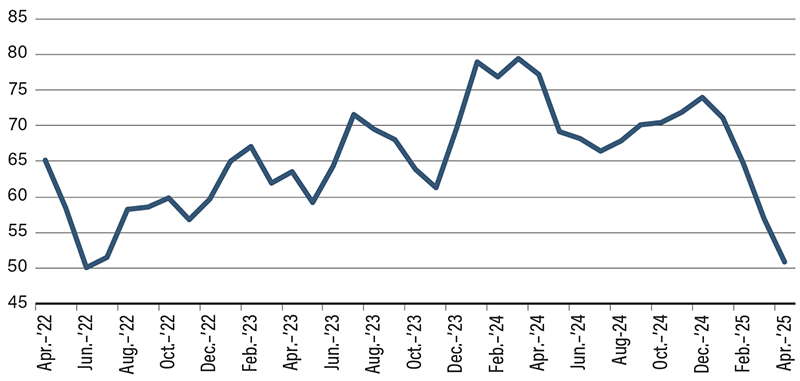

The University of Michigan Consumer Sentiment index continued to fall in April, dropping 11% to 50.8, the lowest reading since June 2022. It is now 30% below its December 2024 level. As worries about trade wars grow, key indicators—personal finances, income, expectations for business conditions, labor market and inflation—continue to deteriorate. Expectations for the labor market took a turn in contrast to the past few years. Consumer assessment of current economic conditions declined 11.4% from the previous month.

Year-ahead inflation expectations surged to 6.7% this month from 5% last month, the highest reading since 1981. If consumer expectations for high inflation in the coming 12 months materialize while sentiment remains low, this could spell trouble for the Federal Reserve. More pessimistic consumers tend to spend less, driving down consumption, which makes up over two-thirds of gross domestic product. This could mean lower growth. A scenario of low growth and high inflation—also known as stagflation—is the worst enemy of the Fed because the central bank simply does not have policy tools to fight it. Raising interest rates would hurt economic growth while lowering interest rates would fuel inflation.

Consumer Sentiment Hits Lowest Point Since June 2022

Source: Trading Economics.

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| Consumer Price Index (Mar.)(YoY) | 2.8% | 2.6% | 2.4% |

| Core Consumer Price Index (Mar.)(YoY) | 3.1% | 3.0% | 2.8% |

| Export Prices (Mar.)(MoM) | 0.5% | 0.0% | 0.0% |

| University of Michigan Consumer Sentiment (Apr.) | 57.0 | 54.5 | 50.8 |