Eyes on the Economy: Job Openings, Spending, Manufacturing

Job Openings Dip to Lowest Point Since March 2021

There were 8.7 million job openings in October. That’s 617,000 fewer than the previous month and below market forecasts of 9.3 million. Although the number is still higher than pre-COVID levels, October’s reading is the lowest since March 2021. The job openings rate was 5.3%, a decline of 0.3 percentage point from a month ago and 1.1 percentage points from a year ago. The monthly decline in job openings was led by the financial sector (-2.1%) and most pronounced in the Midwest (-0.5%) and the South (-0.4%). Information was the only industry that posted growth (1.2%).

Meanwhile, the quits rate remained unchanged at 2.3%. This figure suggests the Great Resignation has ended as the quits rate now stands at the same level as pre-COVID. Workers are staying put in their jobs, indicating that some normalcy has been restored in the labor market.

Income, Spending Slow

Personal income growth decelerated to 0.2% in October from 0.4% the previous month, reflecting a slowdown in compensation and a decrease in transfer receipts. Disposable personal income—income less taxes—slowed from 0.4% to 0.3%. The personal saving rate ticked up slightly from 3.7% to 3.8% but was still roughly half of the typical pre-COVID level, which mostly ranged from 6.5% to 8.5% in 2019.

At the same time, consumer spending slowed to 0.2% from September’s 0.7%. The increase in spending was only seen in services, which was partly offset by a decline in spending on goods. The largest contributors to service expenditure were healthcare, housing and international traveling. The decrease in spending on goods was largely driven by declines in motor vehicle and energy expenditures. Overall, relief in spending and prices was mostly driven by lower energy prices.

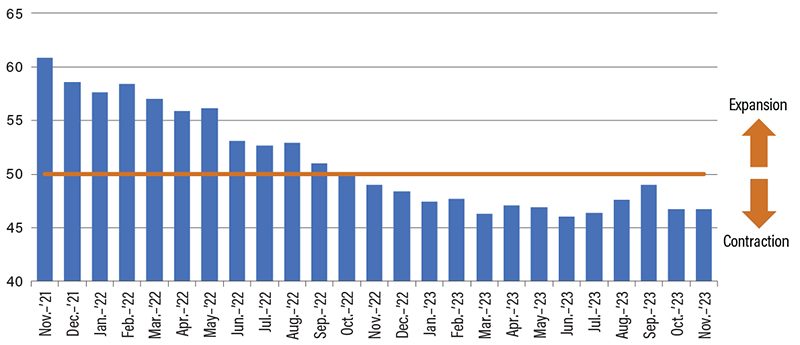

Manufacturing Sector Remains in Contraction

The Institute for Supply Management (ISM) Manufacturing Purchasing Managers’ Index (PMI) remained unchanged at 46.7 in November, below market expectations of 47.6. A reading above 50 indicates expansion while a reading below 50 points to contraction. November’s reading marked the 13th consecutive month of contraction, the longest streak in decades.

The subindex for production fell into contraction from 50.4 to 48.5 as demand continued to weaken. New orders, although improved, has been in contraction for 15 straight months. The employment subindex fell further to 45.8 in November from 46.8 the previous month. Respondents in the ISM Manufacturing PMI survey also indicated that, for every company that was hiring, one was reducing its staff.

Employment reduction may accelerate in the future once backlogs run out. Recall our discussions on how backlogs due to COVID helped to maintain production and employment despite falling demand for goods as producers focused on fulfilling undelivered old orders from the COVID period. The latest figure showed that backlog of orders fell 39.3%, partially unmasking the impact of declining demand on production and employment. Once producers fulfill their previously delayed orders, production and employment levels will see the full impact of weak demand.

U.S. Economy Contracts 13 Straight Months

Source: National Association of Realtors.

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| JOLTs Job Openings (Oct.) | 9.4M | 9.3M | 8.7M |

| Personal Income (Oct.)(MoM) | 0.4% | 0.2% | 0.2% |

| Personal Spending (Oct.)(MoM) | 0.7% | 0.2% | 0.2% |

| ISM Manufacturing PMI (Nov.) | 46.7 | 47.6 | 47.6 |