Eyes on the Economy: Job Quits, Manufacturing, Job Market

American Workers Continue To Quit Their Jobs

The latest figures from the Job Openings and Labor Turnover Survey (JOLTS) suggest that the period of “Great Resignation” is not over yet as the number of job quits barely changed from the previous month. At 4.4 million resignations, April’s figure puts the quits rate unchanged at 2.9 percent.

There is roughly a gap of 5.46 million between job openings and available workers—slightly narrower than March’s figure of 5.6 million. This suggests the gap is narrowing at a slow pace, pointing to a sustained tight labor market.

As workers move around for better wages and working conditions in the midst of high inflation, the figures reported suggest that a majority of people quit for a new job rather than moving out of the labor market.

Services, Manufacturing Ease

In May, the U.S. services sector expanded at the slowest rate since January. The S&P Global U.S. Services PMI is an index tracking variables such as sales, employment, inventories and prices across a wide range of companies in the services sector. The index fell to 53.4 in May from 55.6 in the previous month. The decline reflected weakened domestic and foreign demand due to high selling prices and delays in supply delivery. Nonetheless, a reading above 50 indicates an expansion.

Another index tracking the manufacturing sector edged down to 57 in May from 59.2 the previous month—also the slowest expansion rate since January. Manufacturing cost inflation increased at the fastest rate in six months, leading companies to pass on rising expenses to consumers as reflected in a near-record hike in output charges.

Job Market Slows Down But Still Beats Expectations

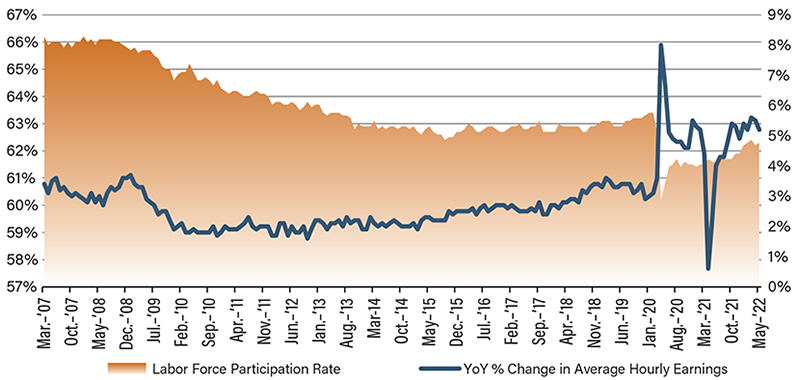

May saw slower but solid growth. The U.S. economy added 390,000 jobs—the fewest since April 2021 but still above forecasts of 325,000. The leisure and hospitality sector led the gains while retail trade had the highest losses. The unemployment rate remained steady at 3.6 percent. For the same month, year-over-year growth in average hourly earnings slowed to 5.2 percent. The labor force participation rate inched up to 62.3 percent from last month’s reading of 62.2. The data suggest that while the labor market has cooled down marginally, it remains tight.

Interestingly, wage growth has been unevenly distributed across the country with places like Colorado and Georgia breaking records in wage gains while the nation’s capital is suffering a decline of 0.2 percent. Although the nationwide job figures suggest there is room for the Federal Reserve to cool down the economy without causing painful unemployment, the wage growth disparities among regions may make the Fed’s job more challenging as the whole country faces the same monetary policy, but not the same wage growth.

Wages Run High as Labor Force Participation Sinks

Source: U.S. Bureau of Labor Statistics

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| Job Quits (Apr.)(MoM) | 4.449M | 4.500M | 4.424M |

| Global S&P US Services PMI (May) | 55.6 | 53.5 | 53.4 |

| Global S&P US Manufacturing PMI (May) | 59.2 | 57.5 | 57 |

| Nonfarm Payrolls (May)(MoM) | 436K | 320K | 390K |

Key Interest Rates

| 6/6/22 | 5/23/22 | Change | |

|---|---|---|---|

| Fed Funds | 1.00% | 0.50% | - - - |

| 1-mo. Libor | 1.16% | 1.01% | 0.15 |

| 3-mo. Libor | 1.67% | 1.52% | 0.15 |

| 2-yr. UST | 2.69% | 2.62% | 0.07 |

| 5-yr. UST | 2.97% | 2.87% | 0.10 |

| 10-yr. UST | 2.98% | 2.85% | 0.13 |

| 30-yr. UST | 3.15% | 3.05% | 0.10 |

Rate Forecast - Futures Market

| Q2-22 | Q3-22 | Q4-22 | Q1-23 | |

|---|---|---|---|---|

| Fed Funds | 1.50% | 2.25% | 2.65% | 2.95% |

| 1-mo. Libor | 1.27% | 2.55% | 3.14% | 3.11% |

| 3-mo. Libor | 1.77% | 2.66% | 3.25% | 3.22% |

| 2-yr. UST | 2.80% | 2.96% | 3.01% | 3.11% |

| 5-yr. UST | 2.96% | 3.05% | 3.03% | 3.11% |

| 10-yr. UST | 3.01% | 3.10% | 3.09% | 3.17% |

| 30-yr. UST | 3.06% | 3.16% | 3.19% | 3.24% |