Eyes on the Economy: Jobs, Interest Rates, GDP

Job Openings Drop

The number of job openings declined for a fourth consecutive month in March, marking an early sign and trend of a cooling labor market. Standing at 9.6 million, March’s job openings figure is the lowest since April 2021 and well below the consensus forecast of 9.775 million. Declines in job openings were seen in transportation, warehousing and utilities while educational services posted an increase.

The number of hires and total separations remained stable. However, within separations, there were increases in layoffs and discharges—particularly in construction, accommodation and food services, health care and social assistance. These are all industries severely affected by labor shortages. Many forecasters have pointed to the strong labor market when arguing against the probability of a recession, often discounting how quickly the jobs picture could change and also disregarding the impact of recent white-collar layoffs—think tech and finance—on blue-collar jobs. We can’t ignore the fact an interconnected economy means layoffs can be contagious.

Fed Approves Another Rate Hike

The Federal Open Market Committee voted to raise the federal funds target rate by 25 basis points, bringing the rate to 5.25%, at its May 3 meeting. While the rate hike was widely expected, markets were watching for hints of a pause. Federal Reserve language in its post-meeting statement didn’t signal more rate hikes. Fed Chairman Jerome Powell stated the central bank is “getting closer and maybe even there,” suggesting a possibility of a pause but leaving it up to an ongoing assessment.

Acknowledging the economy has “slowed significantly” and is continuing to cool, Powell stressed that the labor market remains very tight although labor supply and demand are better balanced now. He expects to avoid a recession and doesn’t see rate cuts as appropriate for the Fed’s current inflation outlook.

Real GDP Falls Short as Growth Begins To Slow

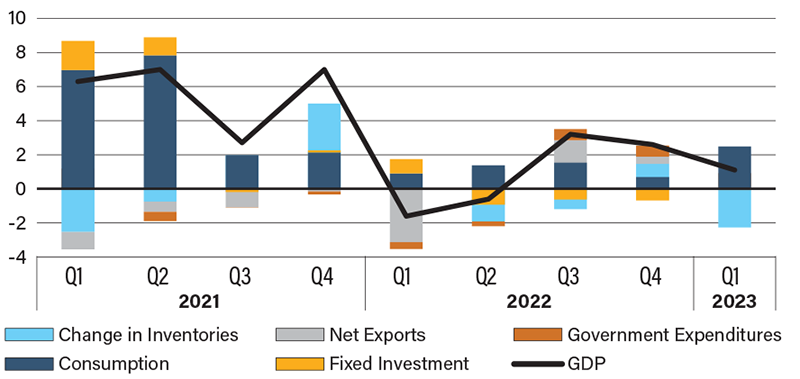

The U.S. quarterly gross domestic product (GDP) growth slowed to 1.1% in the first quarter of 2023, well below forecasts of 2%. Quarterly real GDP growth is more volatile compared with its annual figure. However, breaking down its components and observing their trends is an effective way to understand current economic activity and predict where it is heading.

The first-quarter growth rate, which covers January to March, was largely driven by an acceleration in personal consumption, the biggest contributor. Nonetheless, much of that personal consumption spending happened in January. On a month-over-month basis, there was no personal spending growth in March.

While personal consumption added 2.48 percentage points to GDP growth along with smaller contributions from net exports (0.11 percentage point) and government spending (0.81 percentage point), total investment subtracted 2.34 percentage points. Within the investment account, fixed investment subtracted from growth in the last four quarters while change in inventories, which is more volatile, subtracted from growth in three of the last four quarters. Evidently, our current growth is mostly riding on personal consumption as other net contributors are marginal (net exports) or unstable (government spending due to debt ceiling). Once, and if, consumers hit the brakes, we can say goodbye to economic growth.

Quarterly Contributions to Gross Domestic Product Growth

Source: Trading Economics.

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| JOLTs Job Openings (Mar.) | 9.97 M | 9.78 M | 9.59 M |

| Federal Funds Rate | 5.0% | 5.25% | 5.25% |

| Annualized Real GDP (Q1)(QoQ) | 2.6% | 2.0% | 1.1% |

| Personal Spending (Mar.)(MoM) | 0.1% | (0.1%) | 0.0% |