Eyes on the Economy: Labor, Inflation, Household Income

Nonfarm Labor Productivity Increases in Second Quarter

Labor productivity in the nonfarm business sector increased 3.5% in the second quarter of 2023 from the previous quarter. The second-quarter final estimate fell short of the preliminary estimate of 3.7% but was higher than market forecast of 3.4%. Output increased 1.9%, also falling short of the preliminary estimate of 2.4%. Labor productivity in the current business cycle, which started in the last quarter of 2019, has increased at an annual rate of 1.3%, slightly below the annual rate of 1.4% posted in the previous cycle from the fourth quarter of 2007 to the fourth quarter of 2019.

Hours worked, an important indicator for the labor market, grew at a slow annual pace of 0.6% in this business cycle. For the second quarter of 2023, hours worked declined 1.5%, slightly steeper than the preliminary estimate of a 1.3% decrease, marking the first decline since the second quarter of 2020.

Inflation Picks up in August

The annual Consumer Price Index (CPI) accelerated to 3.6% in August on a year-over-year basis from 3.2% in July, marking the second consecutive month of resurgence from the recent low of 3% in June. We warned that inflation would pick up because June’s low was partly driven by the high base from the previous year as June 2022 was when inflation peaked. Additionally, energy prices—which drove the disinflation in recent months—have begun to resurge, pushing the index higher once again.

When excluding food and energy, yearly core CPI decelerated to 4.3% in August from 4.7% in July. However, on a month-over-month basis, it accelerated from 0.2% to 0.3%, which means core prices were rising faster in August than the previous month. With these observed trends in inflation, the Federal Reserve is unlikely to rule out another rate hike this year.

Real Median Household Income Fell by Most Since 2010

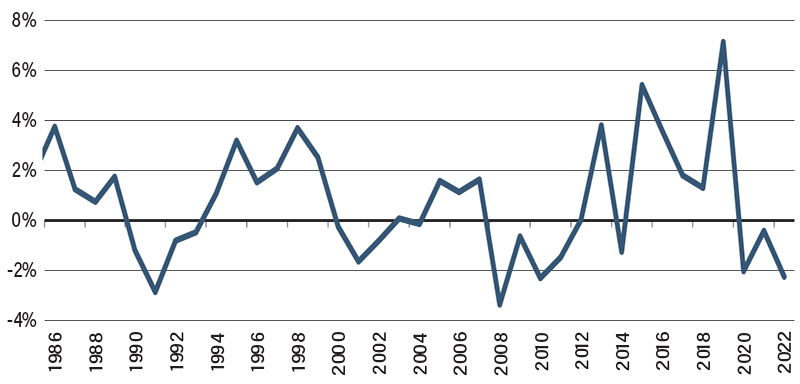

U.S. real (inflation-adjusted) annual median household income decreased 2.3% from $76,330 to $74,580 in 2022, marking the biggest decline since 2010, according to the latest U.S. Census Bureau’s income report. This is the third consecutive year of declines. When calculated post-tax, real median household income declined at an even larger rate of 8.8%.

While so much focus has been placed on nominal wage inflation, real earnings for all workers decreased 2.2% between 2021 and 2022. The reality is Americans became poorer because of rising living costs. Now we have inflation-adjusted data to back that up. The official poverty rate, which excludes taxes and government transfers, edged down slightly. But the supplemental poverty rate, which is calculated post-tax and includes government transfers, rose from 7.8% in 2021 to 12.4% in 2022, the largest one-year increase on record. Child poverty more than doubled from 5.2% in 2021 to 12.4% in 2022.

The U.S. Gini index, which measures income inequality, fell 1.2% when calculated using pretax income between 2021 and 2022. However, post-tax the Gini index increased 3.2%. A decrease in the index indicates a smaller income gap while an increase points to a larger gap. Therefore, the index suggests American income inequality increased after taxes.

Annual Change in Real Median Household Income

Source: U.S. Census Bureau.

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| Nonfarm Labor Productivity (Q2 23)(QoQ) | (1.2) | 3.4% | 3.5% |

| Consumer Price Index (Aug.)(YoY) | 3.2% | 3.6% | 3.7% |

| Core Consumer Price Index (Aug.)(YoY) | 4.7% | 4.3% | 4.3% |

| Real Median Household Income (2022)(YoY) | $76,330 | N/A | $74,580 |