Eyes on the Economy: Manufacturing, Vehicle Sales, Unemployment

U.S. Manufacturing Collapses

The Institute for Supply Management manufacturing index declined from 49.1 to 41.5 in April, marking the third consecutive monthly drop and bringing the cumulative decline to 9.4 points. U.S. manufacturing is being hit hard, and it’s unclear how strongly or quickly it will recover.

New health protocols will have to be implemented at many factories before resuming production. Changes will appear first at the higher-profit and likely nonunion manufacturing plants. Workers will need to use personal protective equipment and undergo daily temperature checks and health screenings. Additional measures include wristband signals when workers are too close to each other and one-way walking patterns. These new protocols take time to establish.

Manufacturing is also hit by the rock-bottom price of oil that has led to a plunge in energy-related investment and production.

Vehicle Sales Crash

At 9 million units, April’s new-vehicle sales set a record low dating back to 1976 for seasonally adjusted annualized units sold. The previous low was 9.2 million units in February 2009. The April sales figure will likely be a bottom for the market as some states have begun to reopen businesses and others are sure to follow.

Still, don’t expect vehicle sales to resume previous trends. Rather, expect a new virus-related normal that is significantly lower. The industry faces headwinds over the next year regarding when production restarts and lack of consumer confidence to venture out to auto showrooms. On top of this, lost jobs and wages will further put the brakes on sales.

Tsunami Hits Labor Market

The labor market endured an unprecedented shock in April with the loss of 20.5 million jobs as states closed down to control the spread of COVID-19. Now we know April’s U.S. unemployment rate shot up to 14.7 percent, and that number will go up since millions more workers have filed for unemployment benefits since the mid-month survey week. Initial unemployment insurance claims for the last eight weeks total 36.5 million.

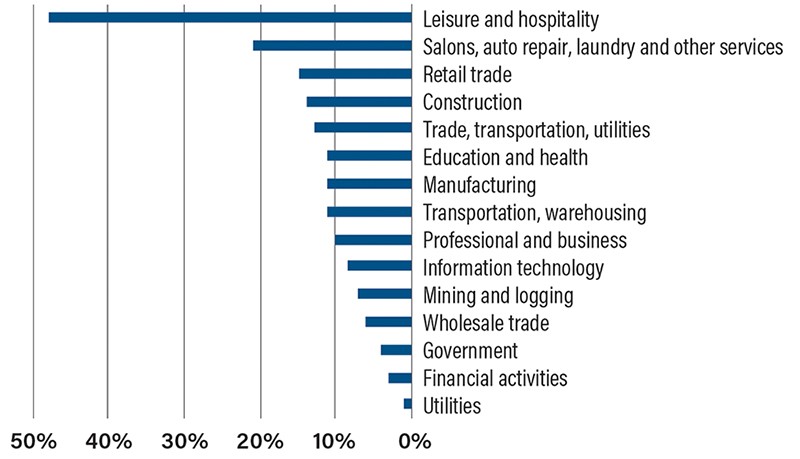

Economists hope most of the layoffs are temporary and the majority of workers will be rehired as businesses start opening up, but don’t expect a complete rebound any time soon. Many retail and leisure/hospitality businesses, which lost an estimated 11.6 million workers in two months, will not see a return to their normal service volumes until a vaccine is available, which is not expected until 2021.

Millions of workers who were laid off temporarily could end up losing their jobs permanently. Numerous businesses have been able to maintain payrolls thanks to government assistance, but that won’t last indefinitely and many will succumb. It’s hard to capture business closure numbers in the establishment data, so economic forecasters may not know the complete devastation brought on by COVID-19 for several years.

Decade of Job Gains Wiped Away in One Month

(Percentage of Jobs Lost by Sector)

All referenced economic data sourced from Bloomberg.

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| ISM Manufacturing Index PMI (Apr) | 49.1 | 36.7 | 41.5 |

| Unemployment Rate (Apr) | 4.4% | 16.0% | 14.7% |

| Nonfarm Payrolls (Apr) | 700K | -20.5M | -20.5M |

| Vehicle Sales (Apr) | 10.8M | 7M | 9M |