Eyes on the Economy: Optimism, Productivity, Inflation

Small Business Optimism Continues To Fall

In April, the National Federation of Independent Business Small Business Optimism Index fell to 95.8, a decline of 1.6 points from the previous month and the lowest reading since October 2024. Despite the drop, the figure came in slightly better than expectations of 94.5. The subindex for uncertainty declined 4 points to 92, reversing some of the spike seen in February’s record high posting. Nonetheless, uncertainty remains significantly above its historical average of 68, highlighting persistent unease, particularly around volatile trade policy.

Confidence in future business conditions weakened in April, with the percentage of owners expecting improvement dropping 6 points to 15%. Expectations for higher real sales also slipped, falling 4 points to a net minus 1%. On the labor front, fewer small business owners reported having job openings they could not fill, signaling softening demand in the labor market.

Business Productivity Declines in First Quarter

In the first quarter of 2025, labor productivity in the nonfarm business sector declined 0.8%. This drop, the first since the second quarter of 2022, came as output fell 0.3% while hours worked rose by 0.6%, indicating less efficiency in production relative to labor input. On a year-over-year basis, however, productivity still posted a 1.4% gain compared with the same quarter in 2024. A notable bright spot was in manufacturing, which saw quarterly productivity rise 4.5%, driven by a 5.1% increase in output, particularly from strong gains in commercial aircraft production.

Meanwhile, unit labor costs for the nonfarm business sector jumped 5.7% in the first quarter, reflecting a 4.8% increase in hourly compensation alongside the decline in productivity. Over the past year, unit labor costs have risen 1.3%, pointing to growing wage pressures despite mixed productivity trends.

Inflation Comes in Softer than Forecast

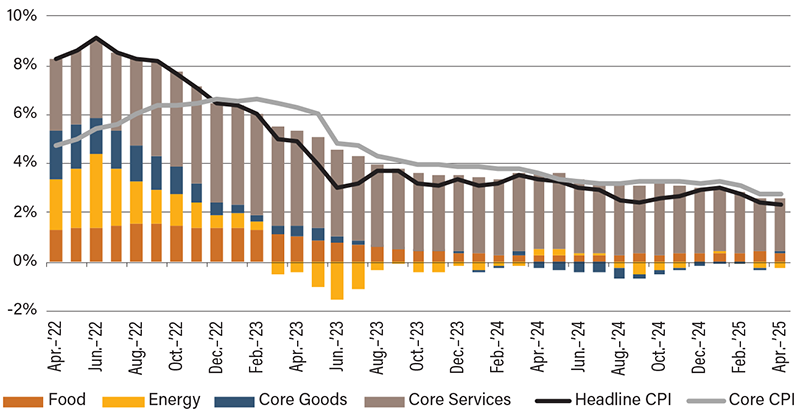

The Consumer Price Index (CPI) annual inflation rate eased to 2.3% in April, marking the lowest level since February 2021. This was down slightly from 2.4% in March and below market expectations. A key driver of the slowdown was a continued decline in energy prices, which fell 3.7%, extending March’s 3.3% drop. Gasoline and fuel oil prices dropped more sharply while natural gas prices surged 15.7%, accelerating from 9.4% the previous month. Price growth also slowed in categories like food and transportation. However, shelter inflation remained steady at 4%. Excluding food and energy, core CPI rose 2.8%, unchanged from March’s core inflation rate.

On a month-over-month basis, CPI rose 0.2%, rebounding from a 0.1% decline in March, but still below the consensus forecast of 0.3%. Shelter costs rose 0.3%, contributing more than half of the total monthly increase. Energy prices climbed 0.7%, as gains in natural gas and electricity outweighed the drop in gasoline. While markets cheered the softer-than-expected annual inflation rate, the month-over-month rebound suggests that underlying price pressure remains persistent. At its recent May meeting, the Federal Reserve held the overnight rate steady at 4.5%, stressing that the central bank is in no hurry to cut rates as inflation remains uncertain.

Contribution to Inflation

Source: U.S. Bureau of Labor Statistics.

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| NFIB Small Business Optimism Index (Apr.) | 97.4 | 94.5 | 95.8 |

| Nonfarm Business Productivity (Q1)(QoQ) | 1.7% | 0.7% | (0.8%) |

| Unit Labor Cost (Q1)(QoQ) | 2.0% | 5.1% | 5.7% |

| Consumer Price Index (Apr.)(YoY) | 2.4% | 2.4% | 2.3% |