Eyes on the Economy: PMI, Consumer Debt, Interest Rates

Business Activity Ticks Up

The S&P U.S. Composite Purchasing Managers’ Index (PMI) increased to 52 in January from 50.9 in December. A reading above 50 indicates an expansion. The slight jump suggests business activity expansion modestly ticked up at the beginning of this year.

The uptick was driven by a faster expansion in the service sector, which came in at 52.5. Meanwhile, manufacturing PMI posted a 50.7, indicating near stagnation but an improvement from contraction in the previous month and the biggest reading since September 2022. Overall, manufacturing new orders increased while output contraction eased. However, supplier and input deliveries worsened—possibly linked to recent vessel attacks in the Red Sea. On the other hand, improved demand conditions and new orders in the service sector boosted market optimism regarding the outlook over the next year, which improved employment in the sector.

Consumer Debt Reaches a New High

Total household debt increased by $212 billion over the final quarter of 2023, marking a 1.2% increase from the previous quarter and reaching a new record high. Credit card debt once again broke records, reaching $1.13 trillion, while auto loan balances continued to increase and are on an upward trajectory. Although student loans remained mostly flat, all other loan balances jumped.

There was an overall increase in delinquency rates. Delinquencies on federal student loans are not reported; thus, the overall delinquency rate is likely higher. The Federal Reserve economic research division found that delinquencies were linked to age—highest among Generation Z (born 1997 to 2012)—and falls as borrowers get older. By income, delinquencies increased most for borrowers in low-income areas. The consumer debt data and the related Federal Reserve research suggest that recent inflation impacts the younger generation and the poor disproportionately more than others.

Federal Reserve Holds Its Target Rate at 5.5%

The Federal Open Market Committee decided to hold the federal funds target rate at 5.5% at its January meeting. More importantly, Fed Chair Jerome Powell rejected market speculations of rate cuts starting at its next meeting in March. If that wasn’t enough to convince markets, then the most recent jobs report surely did the trick.

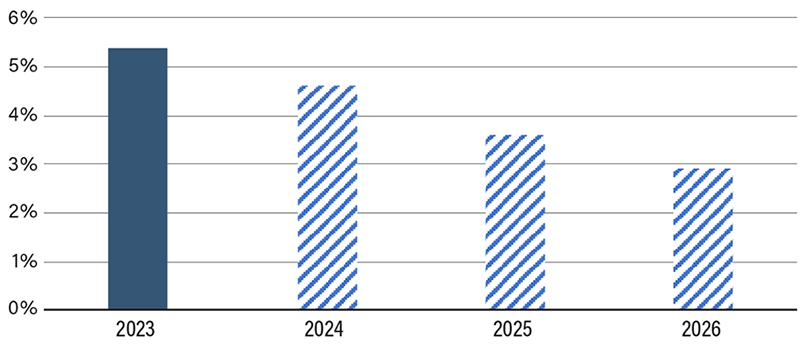

With the latest economic data still pointing to an economy mostly growing at or above its historical average rate, the Fed remains wary of cutting rates too early and risking inflation resurging or plateauing above the target rate. Nonetheless, Powell made clear that the central bank now has a new focus: when to cut rates. In this regard, Fed officials agree they are unlikely to be confident enough by their March meeting that inflation will continue to ease and they can start cutting rates. As stated in CFC’s “2024 Economic and Industry Trends” report, the Fed will likely stall until it is ready to cut rates in mid-2024, possibly in May or June, assuming that inflation is approaching the target rate of 2% and the economy is not crashing. Between now and then, we’ll see plenty of discussion on when balance sheet reduction will slow and come to an end.

FOMC Median Projection for Year-End Fed Policy Rate

Source: Federal Reserve.

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| S&P U.S. Composite PMI (Jan.) | 50.9 | 52.3 | 52.0 |

| Total House Debt (Q4 2023) | $17.29T | N/A | $17.5T |

| Credit Card Balance (Q4 2023) | $1.08T | N/A | $1.13T |

| Federal Funds Rate | 5.5% | 5.5% | 5.5% |