Eyes on the Economy: PMI, Durable Goods, Job Openings

US Private Sector Sits Near Stagnation

The S&P Global Flash U.S. Composite Purchasing Managers Index (PMI) fell to a six-month low of 50.4 in August. A reading above 50 indicates expansion in business activity while below 50 suggests contraction. Thus, at 50.4, August’s reading is near stagnation.

Persistently weak demand in manufacturing accompanied by slow growth in services put a stop to this year’s recovery. Manufacturing PMI fell to 47 and has been in contraction in all but one month this year. Services PMI declined to 51 and has been trending down since May. While still in expansion, business activity in the service-providing sectors was the lowest in six months and clearly signaled slow growth.

Nonetheless, U.S. firms were more upbeat than the previous month in their outlook for output in the coming year. Citing stabilization in interest rates, greater demand and moderation in price pressures, businesses bought into optimism for next year.

Durable Goods See Sharp Decline in July

New orders for manufactured durable goods decreased 5.2% in July from a month ago, marking the sharpest decline since April 2020. The drop was largely driven by plummeting demand for transport equipment. New orders fell 5.4% when excluding defense and increased 0.5% when excluding transport equipment.

While new orders for durable goods are a leading indicator and should provide insights into the state of the economy, the indicator is volatile and often subject to major revisions. It is also not adjusted for population growth and inflation. Only a sustained trend provides reliable insights. Keep an eye on what’s coming in the next few months.

Job Openings Fall Below Forecasts; Will Fed Pause?

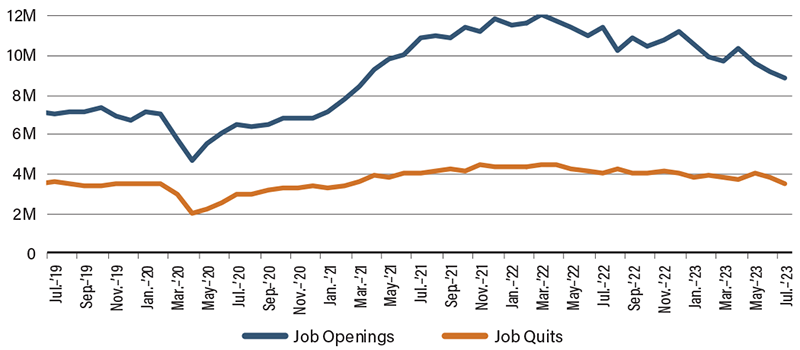

U.S. job openings declined in July for the third consecutive month, falling well below forecasts. Declining by 338,000 from the previous month, July’s job openings sat at 8.827 million, marking the lowest level since March 2021. The decline was most pronounced in professional and business services. In the Job Openings and Labor Turnover Survey, the number of job quits decreased by 253,000 from the previous year, posting the lowest reading in nearly two and a half years.

With signs of the labor market softening, many believe this may help the case for the Federal Reserve to end its hiking cycle, potentially increasing the odds of a soft landing—a scenario in which interest rates rise just enough to curb inflation without triggering a recession. The bad news is, of course, a soft labor market is never a happy event for workers, especially with elevated price levels. However, it must be noted that the job opening levels are still higher than pre-COVID despite recent declines. This suggests the labor market is still somewhat tight. Ultimately, what will guide the Fed’s policy path forward is its understanding of what drives inflation and the risk of resurgence.

Labor Market Loosens

Source: Trading Economics.

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| S&P Composite PMI (Aug.) | 52 | 52 | 50.4 |

| S&P Manufacturing PMI (Aug.) | 49 | 49 | 47 |

| Durable Goods Orders (Jul.)(MoM) | 4.4% | (4.0%) | (5.2%) |

| JOLTS Job Openings (Jul.) | 9.165M | 9.465M | 8.827M |