Eyes on the Economy: Services, Manufacturing, Business Optimism and Jobs

Services Sector Expands; Manufacturing Contracts

The Institute for Supply Management (ISM) Services Purchasing Managers’ Index (PMI) increased to 54.9 in September from 51.5 the month before, beating expectations and marking the largest expansion since February 2023. A PMI reading above 50 indicates expansion while a reading below 50 points to contraction. The services sector was boosted by business activity and new orders, although the subindex for employment in the sector went into contraction. The subindex for prices continued to expand at an accelerated rate, rising to 59.4 from 57.3, the largest expansion since January. This indicates a faster increase of prices paid by firms for materials and services.

Meanwhile, the ISM Manufacturing PMI continued to contract in September, posting a 47.2 and marking a sixth consecutive month of contraction. The manufacturing sector contracted in 22 of the last 23 months. All subindices except supplier deliveries and customers’ inventories were in contraction mode last month. Overall, demand in the sector was weak and output declined. The contrast between the services and manufacturing sectors continues to show the clear divide of the economy where growth is high in one sector while the other is in a recession.

Business Optimism Ticks Up

The National Federation of Independent Business (NFIB) Small Business Optimism Index edged up to 91.5 in September from 91.2 in August but missed market expectations of 91.7. This marks the 33rd consecutive month of the index falling below the 50-year average of 98. The subindex for uncertainty increased 11 points to 103, the highest level recorded. The all-time high uncertainty resulted in hesitation among business owners to invest in capital spending and inventory. As such, the number of owners who reported inventory gains declined to the lowest level since June 2020.

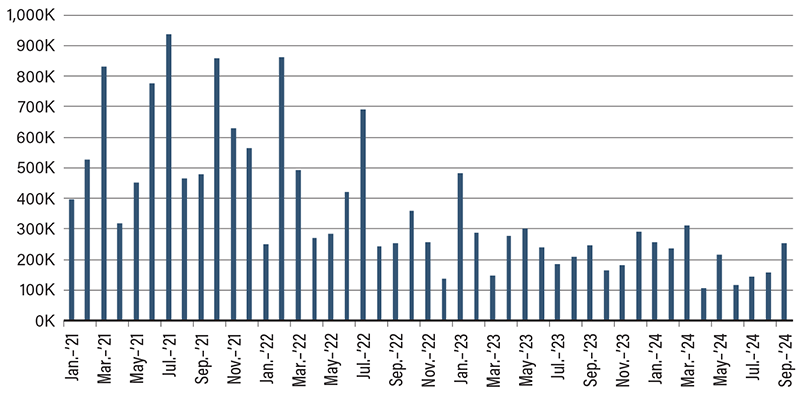

September Jobs Report Surprises, Poses Economic Uncertainty

The U.S. economy added 254,000 jobs in September, well above market expectations of a 140,000 job gain and marking the largest advance in six months. Job gains were once again led by leisure and hospitality, health care and government. At the same time, manufacturing, warehouse and transportation sectors posted job losses. The unemployment rate ticked down to 4.1% from 4.2% while average hourly earnings accelerated to 4% from 3.9%. The labor force participation rate remained unchanged at 62.7%.

The surprise in the jobs report may point to the quick impact of the expectations of rate cuts as well as the jumbo 50-basis-point cut in September. Both expectations and the actual cut might have boosted the economy, raising the question of a potential upside risk to inflation. As the Federal Reserve hopes to cuts interest rates while the labor market cools, a re-acceleration raises uncertainty in the Fed’s rate cut path. After the release of the jobs report, the 10-year U.S. treasury yield jumped to over 4%, a level last seen in July. The upcoming inflation readings will be key—if inflation is on track, it will boost a “soft landing” outlook while any sign of stubbornness or re-acceleration will pose further uncertainty.

Nonfarm Payrolls Cooled Then Recently Ticked Up

Source: Trading Economics.

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| ISM Services PMI (Sept.) | 51.5 | 51.7 | 54.9 |

| ISM Manufacturing PMI (Sept.) | 47.2 | 47.5 | 47.2 |

| NFIB Small Business Optimism (Sept.) | 91.2 | 91.7 | 91.5 |

| Nonfarm Payrolls (Sept.) | 159K | 140K | 254K |