Eyes on the Economy: Small Business, Inflation Moderates, Household Debt Up

Small Business Optimism Ticks Up

The National Federation of Independent Business Small Business Optimism Index rose from 91.5 in June to 93.7 in July. Although the reading is the highest since February 2022, it marks the 31st consecutive month of reading below the 50-year average of 98. Inflation reportedly remained the most important problem in business operations. A net 22% of business owners reported raising average selling prices, while a net 24% planned price hikes. On the labor side, 38% reported job openings that were not filled. Of those who hired or tried to hire, a striking 86% reported few or no qualified applicants. Overall, small business owners are still struggling to attract workers, although 38% said they raised compensation.

Consumer, Wholesale Inflation Moderate

The Consumer Price Index (CPI) decelerated from 3% in June to 2.9% in July, a fourth consecutive month of easing inflation. On a monthly basis, CPI increased 0.2%, more than the 0.1% reading in June. Shelter accounted for nearly 90% of the monthly increase, suggesting that the housing market remains a problem for cost of living. Excluding food and energy, year-over-year core CPI came out at 3.2%, marking a slight deceleration from June’s 3.3%. Core inflation advanced 0.2% month-over-month, a slight acceleration from June’s 0.1%.

Meanwhile, the Producer Price Index—a measure of wholesale inflation—eased to 2.2% year-over-year in July, after rising in the previous months. The reading falls slightly below market expectations of 2.3%. Excluding food and energy, the index eased from 3% in June to 2.4% in July. Overall, both consumer and wholesale inflation readings are signs that the Federal Reserve may be ready to make a rate-cut move in September. Although the month-over-month reading of consumer inflation suggests a slight acceleration, the central bank is unlikely to hold longer, unless the year-over-year trend reverses in the next release.

Household Debt Increases, Credit Card Delinquency Up

U.S. household debt increased from $17.7 trillion in the first quarter to $17.8 trillion in the second quarter, setting a new record. U.S. households now owe $3.7 trillion more than they did at the end of 2019. Between the first and second quarter, the increase was driven by home, auto and credit card loans. Although rising debt often sounds alarming, it’s important to note that, as it is measured in nominal dollars, debt is almost always rising. A better indicator of consumers’ financial struggle (or lack thereof) are delinquency rates.

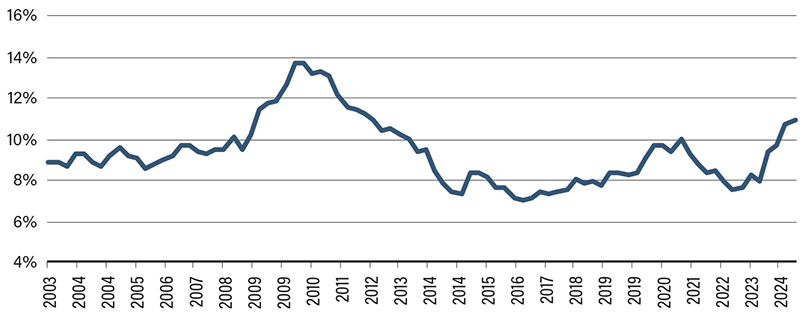

The overall delinquency rate remained low, standing at 1.83% in the second quarter. However, this figure is misleading, because federal student loan delinquencies are not reported until September 2024, due to a directive from the Department of Education. Credit card delinquency rates, however, have been rising alarmingly fast over the last several quarters. Standing at 10.93% in the second quarter, credit card delinquency rates are at the highest level in more than 12 years. The last time rates were higher were in the Great Recession and its aftermath. This suggests that consumers covering rising living costs by carrying larger credit card debt balances with high interest rates have begun to struggle.

Credit Card Delinquency Rate Highest in 12 Years

Source: Trading Economics.

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| NFIB Small Business Optimism Index (Jul) | 91.5 | 91.7 | 93.7 |

| Consumer Price Index (Jul)(YoY) | 3.0% | 3.0% | 2.9% |

| Producer Price Index (Jul)(YoY) | 2.7% | 2.3% | 2.2% |

| Household Debt (Q2 24) | $17.7T | N/A | $17.7T |