Eyes on the Economy: Trade Deficit, Rate Hikes, Labor Market

Trade Deficit Widens

The U.S. monthly trade deficit widened to $67.4 billion in December from $61 billion the previous month. Exports posted a decline of 0.9 percent while imports increased 1.3 percent. Overall, 2022 saw a record-high trade deficit as rising inflation of goods led to a record-high value of imports. The second half of 2022, however, saw some improvement as imports declined, which contributed positively to real gross domestic product (GDP) growth.

With imports beginning to recover—especially with the reopening of China—look for the possibility that the U.S. goods trade balance may suffer. Currently, net exports—exports less imports—are forecast to contribute positively to GDP growth. A worsening goods trade balance could change that outlook.

Fed Slows Rate Hikes

The Federal Reserve slowed its rate hike for a second time as it raised the federal funds rate by 25 basis points in February. The move came after some positive economic releases and was in line with market expectations. Markets are betting on a less aggressive rate hike path going forward and even expecting a cut in the second half of this year. The risk the Fed faces is sending the wrong signal to markets despite what it officially says. This could lead to loose financial conditions, which would work against its efforts to curb inflation.

As it turned out, the Fed was too quick to interpret recent employment data as a sign of the labor market cooling. Only two days after its rate decision, the jobs report posted a surprise gain of more than double the forecast figure. Markets were quick to move their bets for more aggressive hikes with a peak higher than 5 percent and potentially reaching 6 percent. The Fed may be losing control of its narrative, which is dangerous territory for a central bank.

Labor Market Continues To Deliver Surprises

Economists seem to regularly underestimate how tight the labor market has been since the economy reopened. The number of monthly jobs added has consistently beat the forecast over the past year. January was no different, as the number of nonfarm jobs doubled the expected number. Despite layoffs in a few sectors, the U.S. economy added 517,000 jobs, the most since July 2022. The unemployment rate edged down to 3.4 percent while the labor force participation rate ticked up to 62.4 percent. Annual growth in hourly earnings was still high but decelerated to 4.4 percent, the smallest annual growth since August 2021.

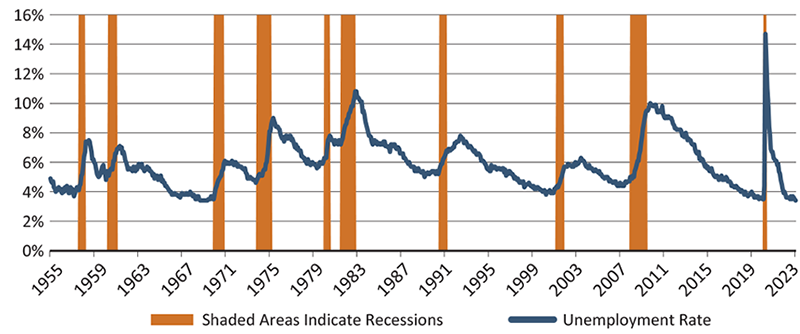

Some economists see the U.S. economy escaping a recession thanks to the low unemployment rate. This argument, however, implies that the unemployment rate is a leading indicator—one that precedes a downturn—which it is not. On the contrary, the unemployment rate is a lagging indicator. Historically, unemployment only rises after, not before, a recession occurs. In fact, unemployment tends to sit at the lowest level of a cycle right before an economic downturn. Should we be worried? Maybe.

Unemployment Rate Rises After a Recession Begins

Source: U.S. Bureau of Labor Statistics

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| Balance of Trade (Dec.) | ($61B) | ($68.5B) | ($67.4B) |

| Fed Funds Rate | 4.5% | 4.75% | 4.75% |

| Nonfarm Payrolls (Jan.)(MoM) | 260K | 185K | 517K |

| Unemployment Rate (Jan.) | 3.5% | 3.6% | 3.4% |