It’s Not Your Parents’ Middle-class Lifestyle Anymore

What constitutes a middle class in the United States? In simple terms, the middle class is typically defined as households with income between 75% and 200% of the national median household income. In reality, socioeconomic classes include income, wealth, social network and other economic means.

The middle class is not some arbitrary income range but the real spending power to afford a relatively average lifestyle as accepted by a given society. In the United States, a middle-class household should be able to afford food for an average-sized family, an average home, educational and medical expenses, reasonable discretionary expenditures, and emergency and retirement savings.

According to the latest data available in 2023, the average U.S. household size is 2.5 people, and the median income of an average-sized household is $100,115. This defines the American middle-class income range as $75,086 to $200,230 before taxes. The median 30-year fixed mortgage payment was roughly $2,100 monthly or $25,200 annually in 2023 (the median rent was roughly close to this amount). This means the lowest middle-class households are cost-burdened—defined as spending 30% or more of income on housing. Further adding to this burden is the average cost of homeowner insurance at $2,285 annually, according to Bank Rate.

The average annual grocery bill (excluding dining out) for a household of 2.5 was $6,249, according to data from a recent U.S. Bureau of Labor Statistics report. Forbes estimated that the average American household spent $5,152 annually on utilities—electricity, gas, phone, internet, etc. Meanwhile, the Bureau of Transportation Statistics estimated the average 2023 household expenditure on transportation to be $13,174 while health care costs $6,159. Adding up all these costs, the average household spent $58,219—or nearly 78% of the lowest middle-class household income—to merely exist before paying for income taxes, basic clothing and educational or vocational expenses.

When income taxes are counted in the mix, the lowest middle-class households likely spend all of their disposable income on necessities without much left for emergency and retirement savings or discretionary spending. If they are only scraping by, could we really consider them middle-class?

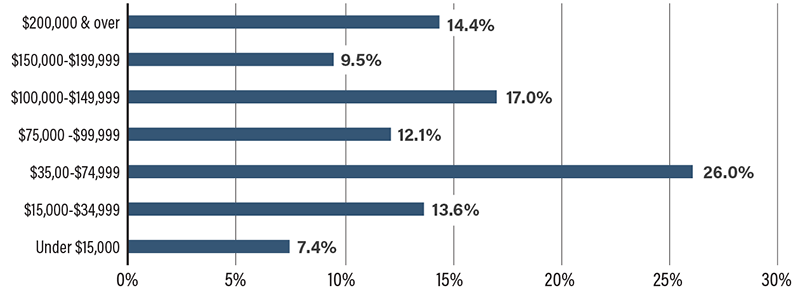

Distribution of American Households by Income Bracket

SOURCE: U.S. Census Bureau.