Eyes on the Economy: Small Businesses, Inflation, Job Openings

NFIB Survey Reveals Fear

The NFIB Small Business Optimism Index increased from 99.6 in May to 102.5 in June. The details generally improved, although small businesses remain pessimistic about the economy’s near-term prospects. Expectations for sales improved and hiring plans edged higher in June. The NFIB’s measure of uncertainty remains high because of the lingering pandemic, taxes and geopolitical issues. Many investors fear the financial markets have become too optimistic. Asset markets are starting to show the impact as stocks have weakened lately, and the 10-year Treasury yield is trading below 1.30 percent.

Inflation Shows No Sign of Softening

The U.S. Consumer Price Index (CPI) came in hotter than expected in June, rising 0.9 percent, beating the market’s forecast of 0.7 percent and the consensus for a 0.5 percent gain. The rise follows increases of 0.6 percent in May and 0.8 percent in April. Year-over-year CPI adjustment is currently 5.4 percent, up from May’s figure of 5.0 percent.

The recent string of hot CPI prints has not yet altered the market’s view that some of the acceleration in inflation is transitory. The reopening of the economy is a one-time event, and that is boosting a number of components of the CPI, including lodging away from home, vehicle rentals and airfare along with admissions to sporting and other events. Other one-time factors boosting inflation are the fiscal stimulus and global semiconductor shortage. Both have reduced the supply of new cars, raising prices at the dealership and driving demand for used vehicles. Vehicle prices added 0.4 percent growth to the headline CPI in June. It’s possible the global semiconductor shortage will extend into next year, but it would be surprising if used-car prices continue to rise by double digits.

Job Openings Illustrate High Demand for Workers

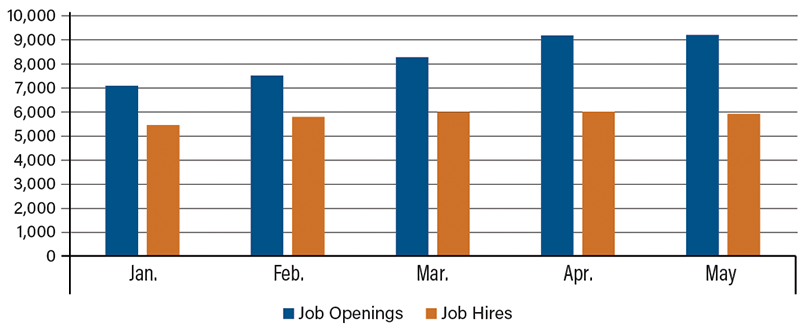

The May Job Opening and Labor Turnover Survey (JOLTS) continued to show high demand for workers as employers try to fill many openings after COVID-19-related restrictions were lifted. At 9.2 million (6 percent of employment), it marked another record for the series. Hiring was little changed at 5.9 million, down from 6 million in April—meaning the gap between job openings and hiring has remained roughly the same.

Businesses are seeking to fill an unprecedented number of job openings, but the situation is challenging because so many employers are seeking workers at the same time. Also, many workers who left the labor market at the beginning of the pandemic or the beginning of the school year have yet to return. Complicating the situation further, many baby boomers decided to go ahead and retire during the pandemic or are retiring now. The resulting labor shortage has boosted job openings to an unprecedented level, but it should come down by year-end. The reopening of schools should bring back many workers. However, the headwind of the aging workforce will remain a constraint longer term. Companies will need to seek ways to squeeze more from leaner workforces or embrace labor-saving technologies.

Job Opening and Labor Turnover Survey

(numbers in thousands)

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| JOLTS Job Openings (May) | 9.3M | 9.3M | 9.2M |

| NFIB Small Business Optimism (June) | 99.6 | 99.5 | 102.5 |

| Consumer Price Index (YoY) (June) | 5.0% | 4.9% | 5.4% |

Key Interest Rates

| 7/19/21 | 7/12/21 | Change | |

|---|---|---|---|

| Fed Funds | 0.25% | 0.25% | -- |

| 1-mo. Libor | 0.09% | 0.10% | (0.01) |

| 3-mo. Libor | 0.13% | 0.13% | -- |

| 2-yr. UST | 0.25% | 0.23% | 0.02 |

| 5-yr. UST | 0.79% | 0.81% | (0.02) |

| 10-yr. UST | 1.31% | 1.38% | (0.07) |

| 30-yr. UST | 1.93% | 2.00% | (0.07) |

Rate Forecast - Futures Market

| Q3-21 | Q4-21 | Q1-22 | Q2-22 | |

|---|---|---|---|---|

| Fed Funds | 0.25% | 0.25% | 0.25% | 0.25% |

| 1-mo. Libor | 0.15% | 0.20% | 0.20% | 0.20% |

| 3-mo. Libor | 0.25% | 0.30% | 0.30% | 0.30% |

| 2-yr. UST | 0.35% | 0.40% | 0.40% | 0.40% |

| 5-yr. UST | 1.10% | 1.20% | 1.20% | 1.20% |

| 10-yr. UST | 1.85% | 1.95% | 1.95% | 1.95% |

| 30-yr. UST | 2.60% | 2.70% | 2.70% | 2.70% |