What Policy Vision Will Kevin Warsh Bring to the Fed?

When central bankers are described as hawks or doves, it often conjures images of serene technocrats pecking at interest rates in a marble tower. But as Kevin Warsh’s nomination shows, sometimes the bird in question has a foot in Wall Street, a feathery tie to political power and an appetite for both growth and inflation-fighting—making him harder to pigeonhole than the usual Fed archetypes.

President Trump’s choice of Warsh to succeed Jerome Powell as Federal Reserve chair has injected fresh debate into monetary policy circles. At first glance, his resume—Wall Street banker, White House economic adviser and former Fed governor—might look like a classic establishment pick. Yet the substance of his views reveals a more nuanced blend of hawkish instincts, recent dovish turns and a keen sense of politics.

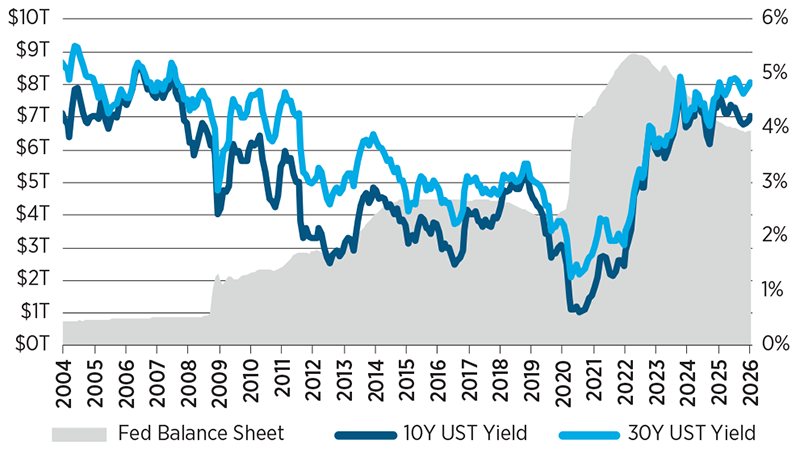

During his 2006–2011 tenure on the Federal Reserve Board, Warsh earned a reputation as a hawk on inflation: He publicly questioned aggressive rate cuts after the 2008 crisis and voiced concern that a swelling balance sheet would fuel future inflation. In 2010, he initially opposed and later reluctantly supported further asset purchases aimed at lowering long-term rates, telling colleagues he wouldn’t have led the effort himself. Those stances garnered him the “hard money hawk” label from some commentators at the time.

Fast forward to 2026, Warsh’s positions have shifted in interesting ways. He has argued in favor of lower interest rates by leaning into the idea that artificial intelligence (AI)-driven productivity gains could allow rate cuts without stoking inflation. That dovish language aligns with Trump’s political push for cheaper borrowing costs, though critics urge caution given mixed evidence on AI’s macro impact.

On the balance sheet, Warsh remains critical: He has called the Fed’s multi-trillion-dollar portfolio of Treasurys and mortgage-backed securities bloated and distortionary, arguing for balance sheet reduction—an inherently hawkish stance because reducing holdings tends to raise long-term interest rates.

What emerges is neither pure hawk nor simple dove. Some observers describe Warsh as flexible rather than doctrinaire, willing to call for cuts while still stressing inflation risks and the dangers of an oversized balance sheet. 2026 will begin to reveal whether Warsh is a hawk, a dove or simply a political animal.

Impact of Fed's Balance Sheet Expansion on Long-Maturity Yields

Source: Federal Reserve Bank of St. Louis.