One Card Rebate Tops $1 Million for Second Straight Year

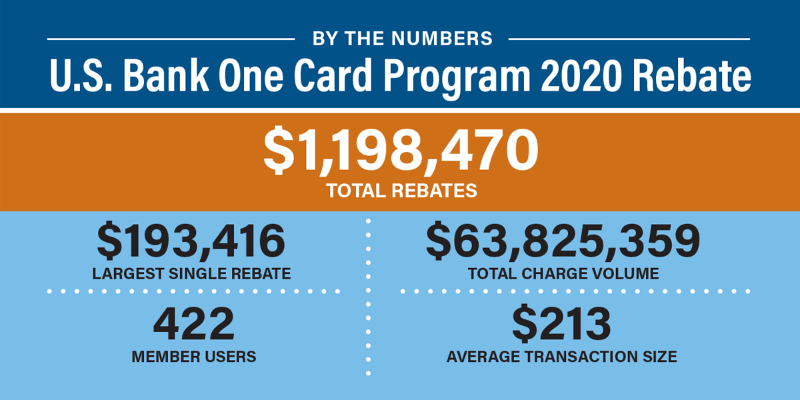

For the second year in a row the CFC and NCSC U.S. Bank One Card topped the million-dollar mark in rebates. The 422 users earned a collective rebate of $1,198,470—nearly matching last year’s record $1.2 million rebate—for the most recent plan year, which ended on August 31.

“Considering the challenges faced by cooperatives due to pandemic-related business disruptions earlier this year, it’s quite the achievement for the program to almost eclipse last year’s record-setting payout,” One Card Program Manager Vicki Reeves shared. “We’re continuously working with U.S. Bank to bring new features and functionality to card users and administrators. We’re excited about new mobile app functionality and the ability for members to add their subsidiaries and fleets so they can increase their overall spend and rebate.”

Rebates Distributed in Late October and Early November

CFC staff will be distributing the rebates—prorated based on card use—in late October and early November. Most systems will receive their payment via ACH, or automated clearinghouse, while those not signed up for ACH will get a check.

To earn a rebate, One Card had to generate an aggregate, annual charge volume of at least $20 million with an average transaction size of at least $100. The portfolio continued to significantly exceed these requirements with annual charge volume of more than $63 million and average transaction size of $213.

Access Online Mobile App Update Adds New Functionality

Earlier this summer U.S. Bank updated its Access Online mobile app to add functionality for program administrators to search and select cardholder accounts, view declined transactions, change account status, credit limits and single purchase limits from their mobile phone.

“One card feature users might not be aware of is the alert and notification functions,” Reeves added. “Card users and administrators can set up 16 different alerts and notifications to help combat fraud, track account activity as well as purchases.”

At the end of this year the U.S. Bank One Card dashboard will be retired and replaced with a new reporting tool that will provide richer reports and data points. Stay tuned for more information on the new Data Analytics reporting tool.