Analysis: Was the Fed Rate Cut Premature?

Virtually everyone, from forecasters to futures markets, correctly predicted that the Federal Reserve would cut rates this month, ending the third-longest stretch of rate hikes. This is a marked change from the past 18 months when forecasters and markets kept predicting cuts that never materialized.

Given the psychology, the Fed may have had no choice but to cut. When markets are sure that something is going to happen and are then proven wrong, people get nervous. They wonder what else they might be wrong about, which causes them to put major decisions—like purchases, investments and hiring—on hold until they can reevaluate. And that increases the probability that the economy will be thrown into recession.

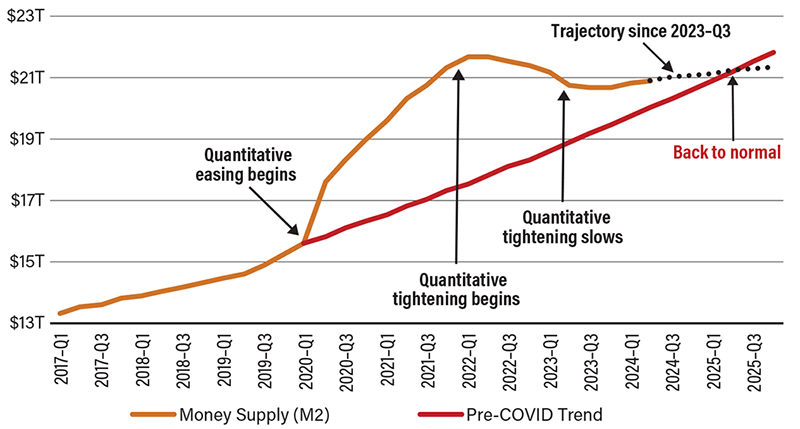

But, while market psychology pointed to the need for a cut, economic fundamentals tell a different story. Prior to 2020, the Fed grew the money supply at a pretty constant rate. It expanded the money supply as it accommodated the government’s stimulus spending starting in 2020, then contracted as it fought inflation starting in 2022. Until last week’s rate cut, the money supply was on a trajectory to return to its pre-COVID path by early 2025. As part of its COVID-era quantitative easing, the Fed increased its balance sheet by buying Treasuries. The balance sheet started shrinking as the Fed held interest rates high. Until last week’s rate cut, the Fed’s balance sheet was on a trajectory to return to its pre-COVID inflation-adjusted level by mid-2025. In addition, until last week’s rate cut, consumer inflation was on a trajectory to return to its pre-COVID average by late 2025.

Economic fundamentals suggest the Fed’s rate cut was premature. Market psychology says the Fed was right on time. And then there’s the politics. No matter what the Fed did, it risked being accused of influencing the election. In this, market psychology provided good cover. The Fed is least likely to appear partisan if it does what virtually everyone wants it to do. And markets were unanimous in that they wanted a September cut.

Money Supply Trend

SOURCE: St. Louis Fed.