Eyes on the Economy: Job Openings, Manufacturing, GDP

Job Openings Fall

The number of job openings decreased to a three-month low of 7.6 million in December, well below market expectations of 8 million. The decline was most pronounced in professional and business services (-225,000), followed by health care and social assistance (-180,000) and finance and insurance (-136,000). The overall downward trend of job openings points to a weakening labor market, although there were a few positive surprises in the nonfarm payroll report.

While unemployment remains low by historical standards, the quit rate has fallen below pre-COVID levels, suggesting that workers are now less likely to leave their jobs. Putting the two reports together, the image of the labor market appears to be one where there are few hirings but also few firings. This is likely the result of employers stuck in limbo as they navigate economic uncertainty and policy changes.

Manufacturing Expands for First Time in 26 Months

The Institute for Supply Management Purchasing Managers’ Index came out at 50.9 in January. A reading over 50 indicates expansion while a reading below 50 points to contraction. This marks the first time that manufacturing economic activity expanded after 26 consecutive months of contraction. The subindex for new orders rose to 55.1 in a third consecutive month of expansion, while the production subindex expanded for the first time after eight months of contraction. On the other hand, the backlog of orders continued to contract. This indicates that weak demand from the previous months still impacted the industry.

Meanwhile, the subindex for prices continued to expand, suggesting that prices have continued to rise, a sign that inflationary forces remain in place. With early signs of demand returning, curbing price growth will be a challenge in 2025.

The Economy Grew 2.3% in the Last Quarter

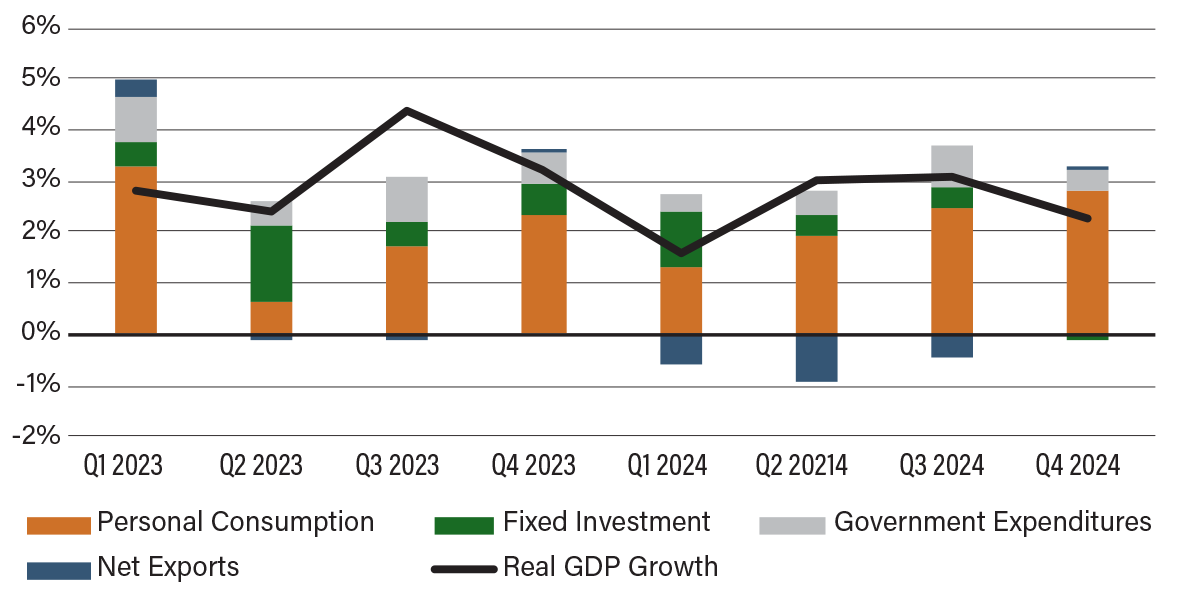

Real gross domestic product (GDP) grew at an annualized quarterly rate of 2.3% in the last three months of 2024. Although slower than the 3.1% growth rate in the third quarter, the fourth quarter’s reading is still slightly above the historical average growth rate. Over the course of 2024, the economy grew 2.8%, well above its historical average of roughly 2%.

In the last quarter, consumption accelerated, hitting a growth rate of 4.2% and contributing 2.82 percentage points to real GDP growth, which was offset by a substantial contraction in private investment. Meanwhile, both imports and exports declined and barely impacted real GDP. Government spending increased 2.5% and added 0.42 percentage point to economic growth.

Overall, consumption almost single handedly carried real GDP growth. This raised the concern about how long U.S. consumers can continue to carry the economy while prices continue to rise. Although the U.S. GDP is widely expected to outperform the rest of the advanced economies and grow steadily above 2%, the risk to economic growth is a potential hit on consumption if there is no relief in prices or additional inflation emerges.

Contributions to Real GDP Growth

Source: U.S. Bureau of Labor Statistics.

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| Job Openings (Dec.) | 8.2M | 8.0M | 7.6M |

| ISM Manufacturing PMI (Jan.) | 49.2 | 49.8 | 50.9 |

| Real GDP Growth (Q4 24)(QoQ) | 3.1% | 2.6% | 2.3% |

| Real Consumer Spending (Q4 24)(QoQ) | 3.7% | 4.2% | 3.0% |