Eyes on the Economy: Mortgage Rates, Gas Prices, ISM

Is Mortgage Relief on the Horizon This Year?

Since 2016, 30-year mortgage rates have ranged from a low of 2.7% to a high of 7.6% and have averaged 4.5%. Also, over that span, and on average, a 100 basis point (bp) change in the federal funds rate has preceded—in the same direction—a 65 to 75 bp change in the average 30-year mortgage rate.

Experts anticipate that the Federal Reserve will cut the federal funds rate by 50 bps by the end of the year. If the historical relationship between mortgage rates and the fed funds rate holds, a 50 bp cut would precipitate a drop in the average 30-year mortgage rate to below 6% for the first time since late 2022.

Pain at the Pump Rises

The average price of gasoline (all grades) last week was $3.29. This is 30% higher than the relatively constant average of $2.53 from 2016 through 2019, though much lower than the peak average of $5.01 in June 2022. Increases in wages have partially offset the pain at the pump. From 2016 through 2019, the median full-time worker earned an average of $875 per week. Given the price of gas at the time, the median full-time worker had to work an average of 6.8 minutes to earn enough to afford 1 gallon of gas (ignoring income and payroll taxes). Today’s median worker needs to work 7.7 minutes—a 14% increase. Interestingly, that’s almost the same as in January 1979 when gas cost $0.73 per gallon, the median worker earned $230 per week and it took 7.6 minutes of work to afford a gallon of gas.

Service Workers, Manufacturing Efficiencies Climb

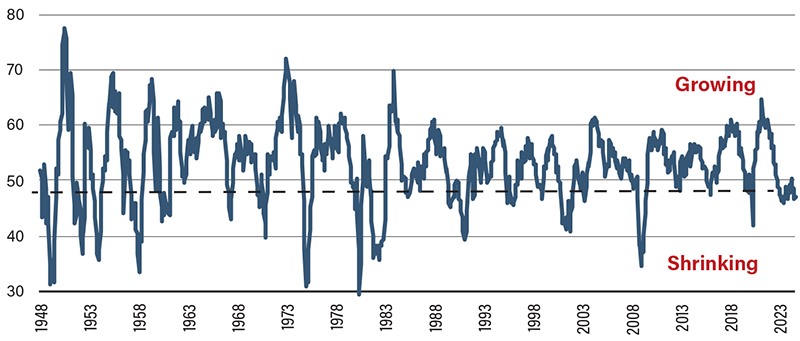

The Institute for Supply Management Manufacturing and Services indices show that the economy’s manufacturing sector continues to contract, though more slowly than last month, while the services sector continues to expand.

The services sector accounts for around three-quarters, or over $20 trillion, of all activity in the U.S. economy. Major components of the services sector include professional and business services (which employs 23 million people), health care services (22 million), and leisure and hospitality services (17 million). Excluding government (which employs 23 million), the services sectors collectively employ over 110 million people. Meanwhile, the manufacturing, construction, utilities, mining and oil/gas extraction industries employ a total of 22 million people.

Some see the shift to fewer manufacturing jobs as an indicator of a weakening U.S. economy. However, a closer look at the numbers reveals something different. Since 1990, the number of workers employed in manufacturing industries has declined by nearly 30%, from almost 18 million workers to less than 13 million today. At the same time, manufacturing output per worker has more than doubled, meaning that the sector has become much more efficient as its workers have become more productive.

Manufacturing Sector Growth Index

Source: Trading Economics

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| Unemployment Rate (Sep.) | 4.3% | 4.3% | 4.2% |

| Initial Jobless Claims (Aug.) | 232K | 230K | 227K |

| Average Price of Gasoline, All Grades (Sep.) | $3.39 | N/A | $3.29 |

| 30-Year Mortgage Rate (Aug.) | 6.85% | N/A | 6.5% |