Eyes on the Economy: Workplace Policies, Unemployment, Fed Rates

Is Amazon an Innovator or Dinosaur in the Workplace?

Last week, Amazon waded into the back-to-office debate, coming down solidly in the “yes” camp when it announced plans to require employees to return to the office five days a week. Despite the company's influence, the move may not lead other businesses to adopt the same policy, as the trend toward remote and flexible work remains strong.

According to a recent Gallup poll, more than 50% of U.S. work locations have a hybrid work policy, 27% are exclusively remote and only 21% require employees to be full-time on-site. These numbers are largely unchanged from late 2022. The appeal of working from home and concerns about retaining employees make widespread adoption of a full-time on-site workweek unlikely. Of employees with remote-capable jobs, 60% say they prefer a hybrid work arrangement, one-third prefer fully remote and fewer than 10% prefer full-time on-site.

July Sees Layoffs Surge

Layoffs were up 5% (YoY) in July versus down almost 2% a month earlier. Don’t get too excited, July’s bump was still only half of May’s nearly 11% increase. From April through July, industries that experienced the largest layoffs, both in absolute numbers and relative to their total employees, were professional and business services (1.6 million layoffs, or almost 7%), construction (630,000 layoffs, or almost 8%) and transportation, warehousing and utilities (426,000 layoffs, or 6%).

Arts, entertainment and recreation employers laid off only 272,000 workers, but that figure was more than 10% of their total employees, so the sector laid off the greatest fraction of its work force.

Total unemployment is up by 600,000 from April through August, bringing the unemployment rate from 3.9% to 4.2%. While that figure is elevated compared with this time last year, the unemployment rate remains more than a full percentage point below its average for 2011 through 2019.

How Will Fed Cut Impact Long-term Treasury Rates?

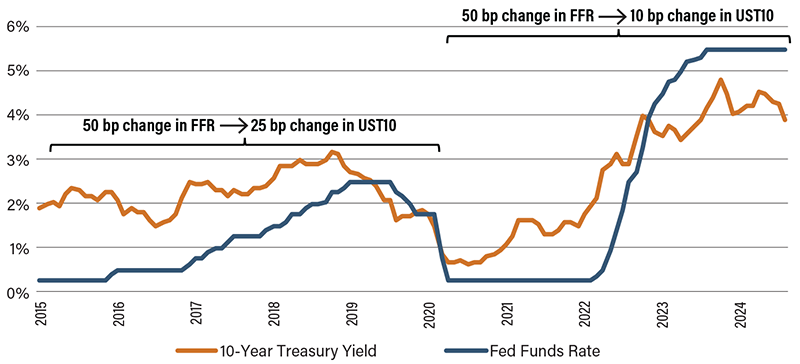

Borrowers cheered the Federal Reserve’s first rate cut in over two years, but unlike pre-COVID cuts, this one may mean less for long-term borrowers. Prior to 2020, the Fed primarily used open market operations (buying and selling Treasuries) to influence interest rates. Since 2020, the Fed’s primary tool has been the interest on reserve balances (IORB), which is the interest rate banks earn from the Fed on the funds they deposit in their reserve balance accounts. With open market operations, the Fed could directly influence Treasury yields across all maturities. But the IORB directly affects only short-term rates. The effect on longer term rates must filter through from the shorter maturities, and so it may be less pronounced.

Comparing changes in the Fed’s interest rate target since 2015 reveals the effect. On average, for each basis point change in the federal funds rate, the 10-year Treasury yield moved half a basis point (bp) from 2015 through 2019, but only one-fifth of a basis point from 2020 through 2024. In contrast, the 3-month Treasury yield moved one basis point for each one basis point change in the fed funds rate during both periods. The take-home is that last week’s 50 bp cut may only translate into a 10 bp decline in longer-term rates.

Federal Funds Rate Change Impact on 10-year Treasuries

Source: St. Louis Fed.

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| Unemployment Rate (Aug.) | 4.1% | 4.1% | 4.3% |

| Layoffs and Discharges (Jul.) | 1.56K | N/A | 1.76K |

| 10-Year Treasury Yield (Sep.) | 3.87% | N/A | 3.75% |

| CPI Inflation (Sep.)(YoY) | 2.9% | 2.6% | 2.5% |