It’s Not Baseball, But Global Economy Hits a Triple

With the lockout between major league baseball owners and players coming to an end soon, it seems as though the only triple hit taking place right now is against the global economy. Inflation, monetary policy tightening, and geopolitical risk together will have a negative impact on the current global recovery.

Though investors typically shrug off geopolitical tensions, the Ukraine crisis has weighed on the financial markets because of Russia’s central role in global energy markets. Russia produces about 10 percent of the world’s oil supply, on par with the United States and Saudi Arabia, and surging energy costs will ripple quickly through the global economy.

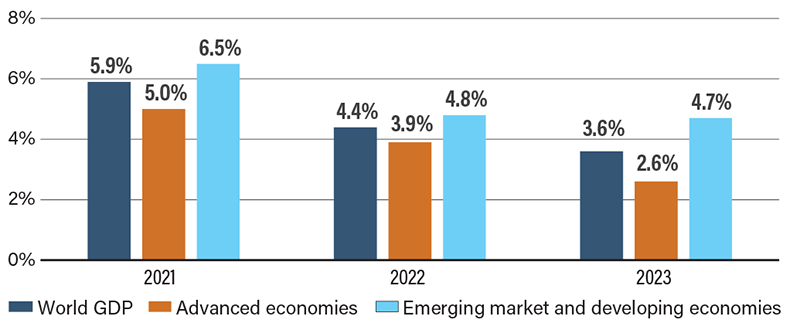

Before Russia invaded Ukraine, the International Monetary Fund had already downsized expected 2022 world growth due to virus caseloads, disrupted recovery and high inflation. Now, the stakes are even higher. And it doesn’t matter if you are an advanced economy like the United States, or a large emerging economy like China, almost every major economy is expected to slow down.

Previously, the Federal Reserve had mapped out a triple of interest rate hikes for 2022. In Fed Chairman Jerome Powell’s recent testimony before Congress, he reiterated that the geopolitical situation plays a central role in the Fed’s view of the rate path forward. With the war creating a highly uncertain economic environment, the rate-setting Federal Open Market Committee must proceed carefully.

Unfortunately for the Fed, its job to successfully slow the economy just got a lot harder. In fact, former Secretary of Treasury Lawrence Summers has stated the next recession will likely be caused by the Federal Reserve. According to Summers, by falling behind in its efforts to combat inflation, the central bank will ultimately need to tighten monetary policy by more than what the financial markets currently expect.

Effectively reducing inflation and avoiding a recession was always very difficult task, but it’s even harder now with oil at more than $120 a barrel and climbing. It will be nearly impossible for the Fed to hit a home run on this one.

International Monetary Fund World Growth Projections