Maybe Today’s Economists Should Become Meteorologists

In a world where you can be anything, don’t be an economist at a time of economic uncertainty, armed conflicts, severe weather, multiple plane crashes and trade wars. It’s more work with the same pay and predictably wrong forecasts. If you want to make predictions, do it about the weather. But if you must be an economist, don’t be tempted to analyze the impact of tariffs on long-maturity interest rates.

Potentially, there are three channels through which tariffs can impact interest rates: inflation, government revenue, and investor sentiment and risk perception. First of all, tariffs tend to increase prices, especially for goods with few substitutions. When the overall price level increases, so does inflation. This may force the central bank to raise interest rates to curb inflation—unless the tariffs are seen as a one-time inflationary shock. In that case, the central bank may not take action.

Secondly, if tariffs lead to an increase in government revenue, fiscal health improves. This reduces borrowing needs and, therefore, borrowing cost for the government—i.e., Treasury yields. Overall, long-maturity rates decrease. However, if increased revenue is accompanied by increased spending, this may have an inflationary impact, forcing the central bank to raise interest rates.

Thirdly, tariffs may sway investor sentiment and risk perception. As seen recently, tariff fears lead to declining stock markets. Bonds have to keep up with risk-adjusted stock returns. Once stocks decline, bond yields may fall because investors flee to bonds, which are considered safer assets. However, if tariffs turn investor perception of the U.S. economy gloomy compared with other economies, capital may flee abroad, causing domestic interest rates to rise.

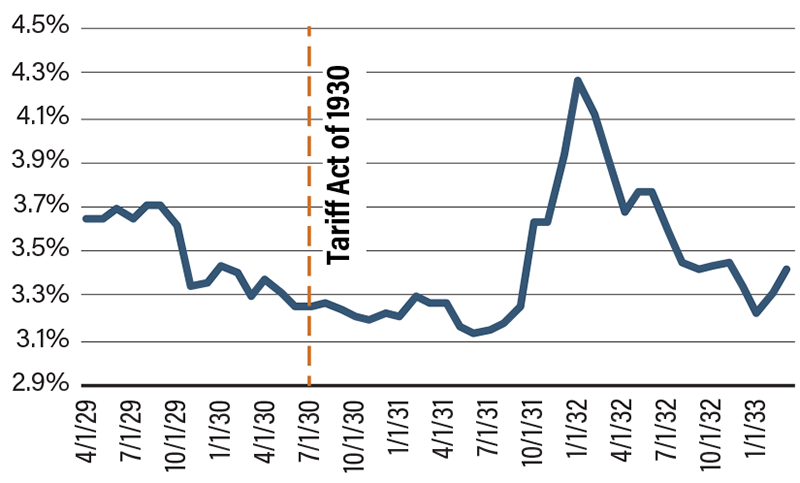

In 1930, the United States enacted the Smoot-Hawley Tariff Act to fight the Great Depression. Within one year, interest rates started rising and the depression became more severe, forcing the Federal Reserve to lower interest rates—but the economy was already severely damaged.

All things considered, tariffs are a double-edged sword. The benefits come with drawbacks. The balance is hidden in the fine print—and no, don’t expect an economist to find it.

10Y UST Spiked One Year After Tariffs

SOURCE: Trading Economics.