Oh Deer! Threat of Stagflation Bounds into View

Back in 2022, we wrote about the fears of stagflation. Three years later, we’re once again staring at the possibility of this economic phenomenon characterized by a period of high inflation accompanied by stagnant economic growth and high unemployment. Stagflation does not have a formal definition. Economists say “high inflation” but do not specify the threshold for what constitutes high inflation. Likewise, there is no threshold for what constitutes stagnation and high unemployment. So how do we know if we are experiencing stagflation?

The bitterest of all pills, stagflation was once thought to be impossible as high inflation was typically associated with a hot economy. In 1965, the term was first used by British politician Iain Macleod to describe the state of the British economy. We heard about stagflation again in the United States during the 1970s oil crisis. Dominated by Keynesian economics—which sees macroeconomic policy as a trade-off between employment and inflation—our economic system is designed to combat high inflation or high unemployment but not both. We typically spend our way out of low economic growth as both the federal government and Federal Reserve have been quick in stimulating the economy, so stagflation is a rare phenomenon. Without a formal definition, we rely on experts’ consensus to identify stagflation. So far, experts have only called stagflation once in the United States, and it began in the 1970s.

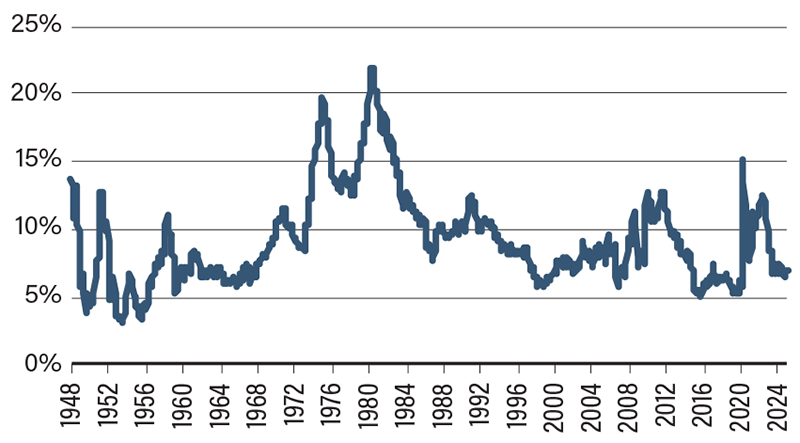

With its characterization, stagflation is best illustrated by the misery index, which is calculated by adding inflation rate to unemployment rate. Between the early 1970s and early 1980s, the misery index was mostly in the double digits—at one point running as high as 21.9%. Since then, the misery index broke into the double digits several times, but only briefly. From April 2021 to November 2022, the misery index ran in the double digits. Although there were fears of stagflation then, experts never called it. This was likely because the unemployment rate did not run high enough. Currently, the misery index is just above 6.9%. Both inflation rate and unemployment rate will have to rise significantly and for a sustained period of time before stagflation becomes a reality.

Misery Index Currently Well Below 10%

SOURCE: Federal Reserve Bank of St. Louis.