Eyes on the Economy: Auto Sales, Payrolls

Chip Shortage Looms Over Auto Sales Recovery

New light-vehicle sales came in well above expectations in January. The U.S. auto market continues to outperform the economy in general. For example, real consumer spending for all goods fell by 1.4 percent from November to December. At the same time, spending on motor vehicles and parts rose by 3 percent, the most of any category. New-vehicle sales continue to be a large part of this spending equation with the seasonally adjusted annual rate (SAAR) of sales in January reaching above 16.6 million for the first time in 11 months.

However, the road ahead has a few speed bumps. Used-vehicle prices were up more than 15 percent in January compared with 2020 levels. The inflated used-vehicle prices are pushing buyers toward the new market. However, new-vehicle supply may once again be challenging. Automakers are reporting significant shortages in semiconductor chips, which are major components of the modern auto. The chip shortage has caused plant shutdowns in the U.S. and around the world, holding back growth in the near term. Where are these chips going? To other durable goods like televisions, computers and iPhones.

Growth was expected to be hovering in the mid-16 million SAAR range for the first half of the year, but supply limits may hold units sold to the low-16 million or possibly 15 million range. Interestingly, consumers remain interested in getting behind the wheel for personal travel while public transit and air traffic have yet to bounce back to anywhere near pre-pandemic levels.

Payroll Barely Recovers as Job Creation Slows

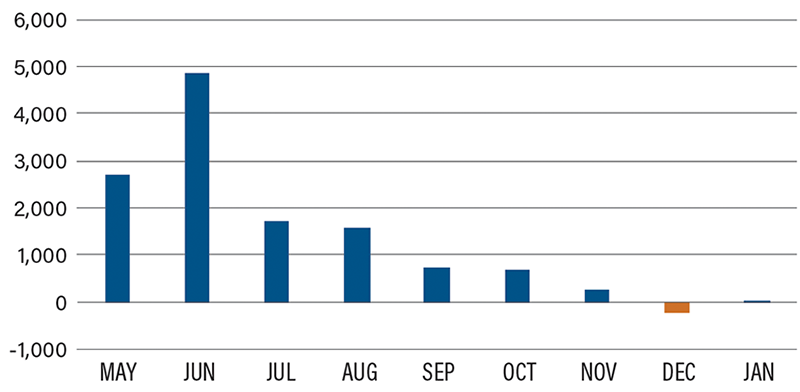

The pandemic continues to stymie the labor market. There were 9.9 million fewer U.S. jobs in January than in February 2020 as cumulative nonfarm payroll jobs fell from 153 million to 143 million. Fifty-six percent of jobs lost due to the pandemic since last April have been recovered. While analysts are optimistic about a rapid recovery once vaccinations lead to herd immunity, expect the labor market to continue to disappoint for several more months.

The January numbers continue to reveal the bifurcation of the unemployment crisis as consumer-facing industries struggle while those with employees that have the luxury of working from home fare better. Retail, leisure/hospitality and other service sectors lost jobs; information technology, finance and professional/business services continued to hire. Some companies are even reporting difficulty finding qualified workers.

The economic slowdown is now hitting state and city employment where it is estimated one in 20 jobs has been slashed because of falling revenue. The pandemic has also accelerated shifts into e-commerce and online educational services while fast-tracking productivity enhancements like automation, which will mean fewer jobs are available on the other side of the pandemic. This will be compounded by the number of businesses that have failed, leaving no jobs for Americans to return to.

Monthly Nonfarm Payrolls (Numbers in Thousands)

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| Vehicle Sales (Jan.) | 16.3 M | 16.4 M | 16.6 M |

| Nonfarm Payrolls (Jan.) (MoM) | 140,000 | 50,000 | 49,000 |

Key Interest Rates

| 2/15/21 | 2/8/21 | Change | |

|---|---|---|---|

| Fed Funds | 0.25% | 0.25% | -- |

| 1-mo. Libor | 0.11% | 0.12% | -0.01 |

| 3-mo. Libor | 0.19% | 0.20% | -0.01 |

| 2-yr. UST | 0.11% | 0.11% | -- |

| 5-yr. UST | 0.50% | 0.48% | 0.02 |

| 10-yr. UST | 1.20% | 1.19% | 0.01 |

| 30-yr. UST | 2.01% | 1.96% | 0.05 |

Rate Forecast - Futures Market

| Q1-21 | Q2-21 | Q3-21 | Q4-21 | |

|---|---|---|---|---|

| Fed Funds | 0.25% | 0.25% | 0.25% | 0.25% |

| 1-mo. Libor | 0.10% | 0.10% | 0.10% | 0.10% |

| 3-mo. Libor | 0.20% | 0.20% | 0.20% | 0.20% |

| 2-yr. UST | 0.20% | 0.30% | 0.30% | 0.40% |

| 5-yr. UST | 0.50% | 0.60% | 0.60% | 0.70% |

| 10-yr. UST | 1.00% | 1.10% | 1.20% | 1.30% |

| 30-yr. UST | 1.80% | 1.90% | 2.00% | 2.10% |