Inflation Might Be a Stickier Problem Than Most Think

Americans, like the rest of the world, have seen gasoline prices surge and stocks plunge recently. It’s no wonder we’re all fretting as we get a daily dose of more uncertainty, higher inflation and less economic growth. The term most often used to describe slow or negative growth coupled with high inflation is stagflation—something the U.S. has not experienced since the late 1970s.

While inflation was dubbed “transitory” in 2021 because of the supply-chain bottlenecks, there are four important reasons why it may hang around longer than many analysts believe. Starting from a broader view, globalization as we know it has slowed down. Tariffs, COVID and Russia’s invasion of the Ukraine along with fragmented globalization have led to higher production costs.

Next, the global net zero emission push isn’t cheap. The BlackRock Investment Institute estimates consumer prices could rise by as much as 4 percent a decade if the transition costs are fully passed on to households. Ironically, air pollution itself is a common example of a negative externality where the cost of poor health due to pollutants has to be borne by society. If we are going to pay for something, it might as well be clean air.

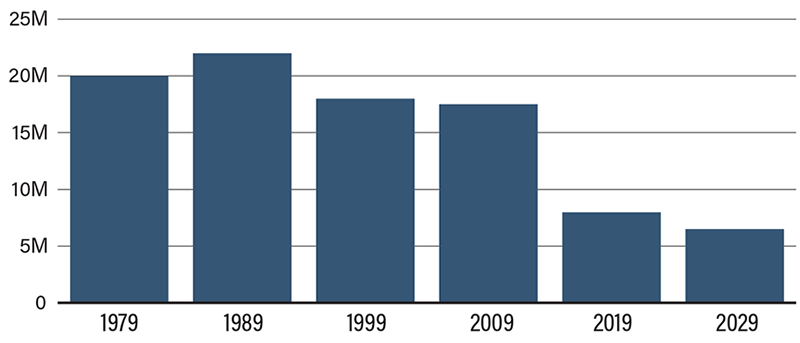

The shrinking U.S. labor force is the next factor. Where will companies find the necessary workers they need to produce their merchandise? Our 2021 population growth was the lowest annual posting on record dating back to 1776. The ongoing retirement of the baby boomer generation combined with tighter legal immigration is limiting the number of Americans available for hire, which might push up wages and be a good thing for those willing to work.

Housing is also a market looking at a shortfall. Elevated demand from aging millennials is running up against a constrained housing supply. The housing bust of the Great Recession drove small homebuilders out of business, leading to a supply shortfall of up to 2 million homes. It will take years for the construction cycle to clear. Between the overheated demand and rising mortgage rates, home affordability is on the decline for many.

All these trends could easily mean inflation hangs around longer than analysts think, especially since most have never experienced stagflation to begin with.

Growth in U.S. Labor Force (Change in Decade Average)

Source: Bloomberg