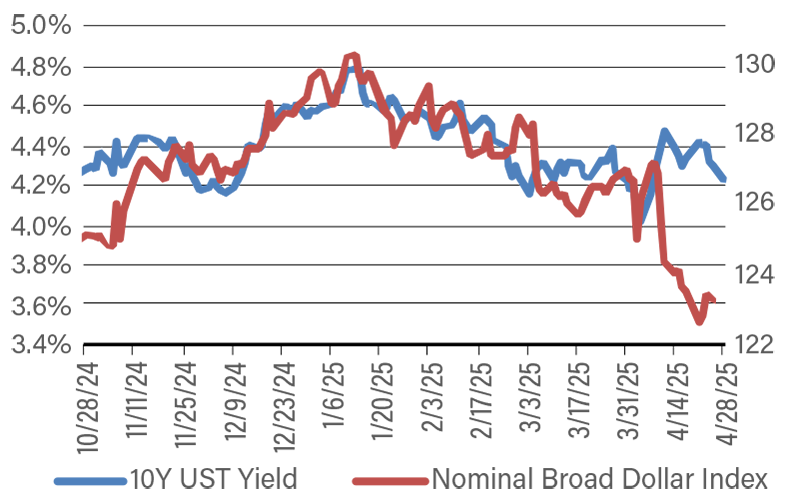

US Dollar Declines While US Treasurys Stay Strong

A few years after COVID, we may have fully reopened our economy, returned to offices and dropped our masks, going about life as if we have restored normalcy. Deep down, we all know the world will never be the same again. Just look at the U.S. Treasury yields and the dollar. Historically, the dollar appreciates when Treasury yields increase. But it’s post-COVID 2025, so “historically” is thrown out of the window. Starting in mid-April, a rare phenomenon occurred: The dollar declined despite U.S. Treasury yields staying high and even rising at times.

A simple explanation for the historical relationship between the dollar and U.S. bond yields is that, ultimately, interest rates in the United States drive demand for U.S. currency—as high interest rates attract investors, who would need the dollar to buy U.S. bonds, pushing up demand for the dollar. The unusual thing about markets in April was that tariffs triggered fears that led to the depreciation of the dollar. If the current trade war had been only between the United States and China, the dollar would have probably strengthened. But since the trade tensions are spreading across the world, markets are anticipating lower global trade volumes. Because the dollar is used to settle the majority of international trade, lower trade volumes means less demand for the dollar.

Meanwhile, another unusual concurring trend is that current global economic fears are not leading to rising demand for U.S. Treasurys. Historically, U.S. Treasurys are safe havens to which investors flee when economic uncertainty occurs, driving down yields. Now, despite the chaos, spooked investors are not flooding the Treasury market, which could also be explained by the fact trade tensions are between the United States and the rest of the world. Foreign investors hold approximately $22 trillion in U.S. assets, half in equities. While they are not fleeing the United States, they are cautious about increasing capital inflows for now.

Make no mistake. The dollar weakness and elevated Treasury yields do not equate to a loss of reserve currency status. There is still simply no other currency that can take on the role.

The Dollar Falls While Treasury Yields Remain High

SOURCE: Federal Reserve Bank of St. Louis.