The Data Center Surge: What 2026’s Fastest-Growing Sector Means for Utilities

2026 Industry Trend

Despite the economic, policy and industry uncertainty in 2026, one area that utility analysts are sure about is the expectation for significant electric utility load growth this year, largely driven by data centers.

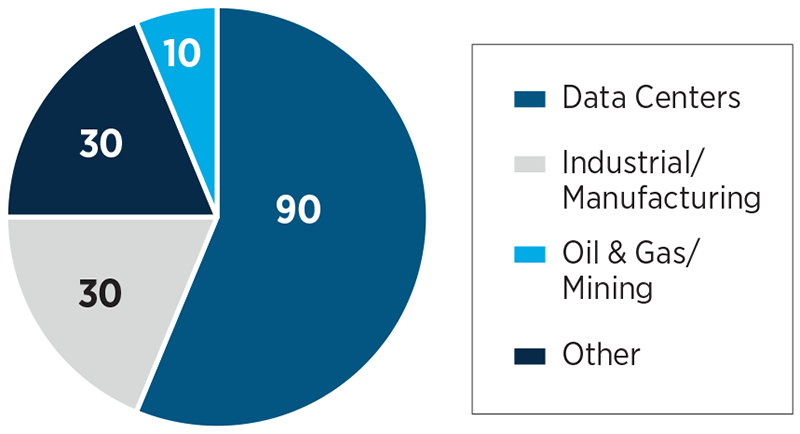

According to consulting firm Grid Strategies, electric utility planning areas in the U.S. are forecasting a peak load growth of 90 GW from data centers through 2030. This represents more than 9% of the total peak load forecast.

Drivers of Load Growth in GW (2025-2030)

SOURCE: Grid Strategies.

While this projection is based on Federal Energy Regulatory Commission-submitted load forecasts, there is an important caveat: These estimates are often overstated due to speculative projects, market constraints and timing issues, which are all becoming increasingly common as new data centers compete for limited grid resources.

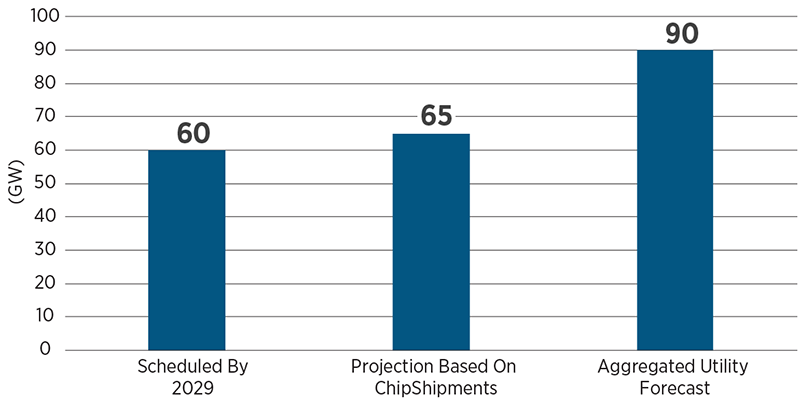

Alternative forecasts, by comparison, paint a more pessimistic outlook. Based on anticipated purchases of processing chips, the U.S. data center industry is expected to grow by 65 GW through 2030, almost 28% lower than the aggregated utility forecast, according to Grid Strategies.

Alternative Benchmarks for Data Center Load Growth

SOURCE: Grid Strategies.

As the data center industry continues gaining momentum at an alarming rate, developers, utilities and regulators are strategizing ways to support ongoing growth in the industry while mitigating adverse impacts on consumers and the power grid.

About two-thirds of U.S. power consumption comes from state or regional grids, where grid operators manage energy trading. The costs of wholesale energy are passed on to consumers through their electricity bills, which also include other charges necessary for maintaining and expanding the system. Notably, even consumers who are not located near data centers can still be affected if their energy supply relies on the same grid network.

Wholesale power prices are measured in real time on the grid by Locational Marginal Pricing points known as nodes. Examining these nodal price changes over time reveals how this rapidly expanding industry is putting enormous stress on consumers and the power grid.

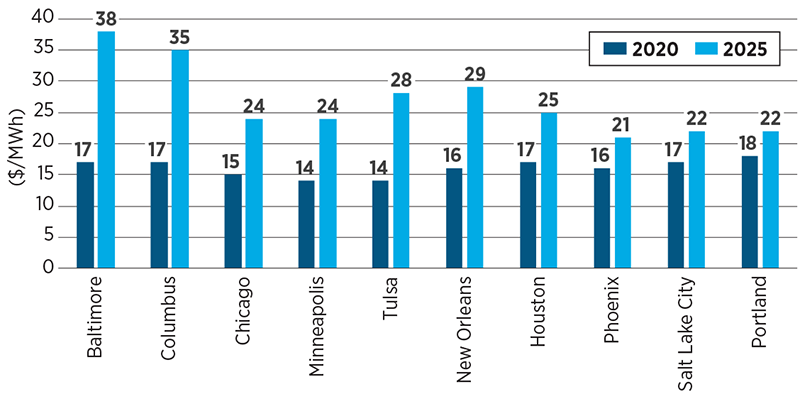

Locational Marginal Pricing Increases

SOURCE: Bloomberg.

According to a Bloomberg analysis of more than 25,000 nodes operated by seven regional transmission authorities, wholesale power prices in 2020 averaged around $16/MWh, with slight regional variations. Today, prices are far more location dependent. In 2025, wholesale prices had more than doubled in some regions compared to 2020, with many of the largest increases concentrated near data center hubs. In fact, of the nodes that reported price increases, 70% were located within 50 miles of large data center activity.

With power demand growing significantly, power supply is getting tighter and transmission congestion is increasing. According to a survey from Schneider Electric, the most significant factors slowing down data center development are utility capacity or transmission constraints, with 92% of respondents listing these as major challenges.

As these constraints intensify, data center developers and regulators are innovating by making a push for more co-located or on-site generation at these facilities, especially for larger data centers that require significant capacity and transmission at scale. These strategies help developers minimize risks from grid constraints while also reducing their impact on everyday consumers.

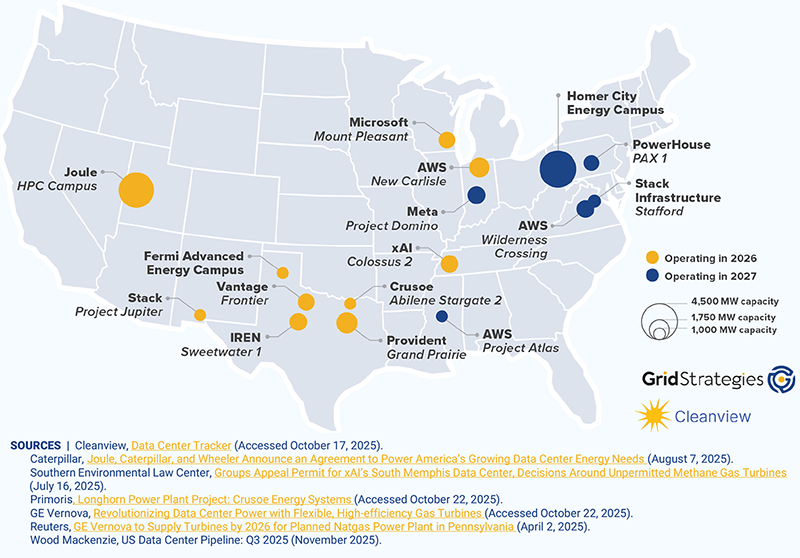

According to Grid Strategies, 16 GW-scale data centers are expected to come online in the next two years, with a total aggregate demand of nearly 30 GW. Of those, only six projects are planning co-located or on-site generation. In addition, data from Wood Mackenzie shows that just 9% of tracked data center projects are planning on-site generation.

However, the projects planning for on-site generation tend to be very large and represent one-third of the total projected capacity being tracked. CFC anticipates this trend will become more common in the coming years.

GW-Scale Data Centers Expected Online 2026-2027

What Does this Mean for Electric Cooperatives?

As cooperatives continue to field inquiries from new data center members, it will be crucial to prioritize risk management and cost recovery. Before serving a data center, cooperatives should establish clear strategies for managing risk and recovering costs. This includes having financial safeguards in place to mitigate the risk of overbuilding and to protect existing members from negative impacts.

Equally important is planning for uncertainty. With the data center industry growing at an unprecedented pace, electric cooperatives must remain flexible to navigate market constraints and unforeseen challenges. During the planning phase, cooperatives should evaluate how increased lead times and costs for sourcing equipment and building infrastructure—among other market changes—could affect their ability to provide service and manage risk. Watch recent CFC videos “NOVEC Leaders Share Insights on Managing Data Center Growth” and “How REC Manages Unprecedented Growth While Mitigating Risks” for examples of how Northern Virginia cooperatives are addressing data center growth and associated risks.

We also recommend close coordination between retail service providers and wholesale power suppliers to ensure the necessary capacity, infrastructure and supplies are in place to meet data center standards without exposing existing members to unnecessary risk.

Finally, we encourage electric cooperatives to be proactive about engaging with members and local communities when serving data centers. Members need to know how data center growth will affect their rates and service reliability. In addition, cooperatives should encourage data center developers to participate in community activities to build trust, address concerns, align projects with community expectations and demonstrate their commitment to being good neighbors.

By following these best practices, electric cooperatives will be well-positioned for success as they serve new data center loads.

CFC members can learn more about how data centers are transforming the energy landscape by downloading CFC’s issue brief, “Powering the AI Boom: What Data Center Growth Means for Electric Cooperatives.”